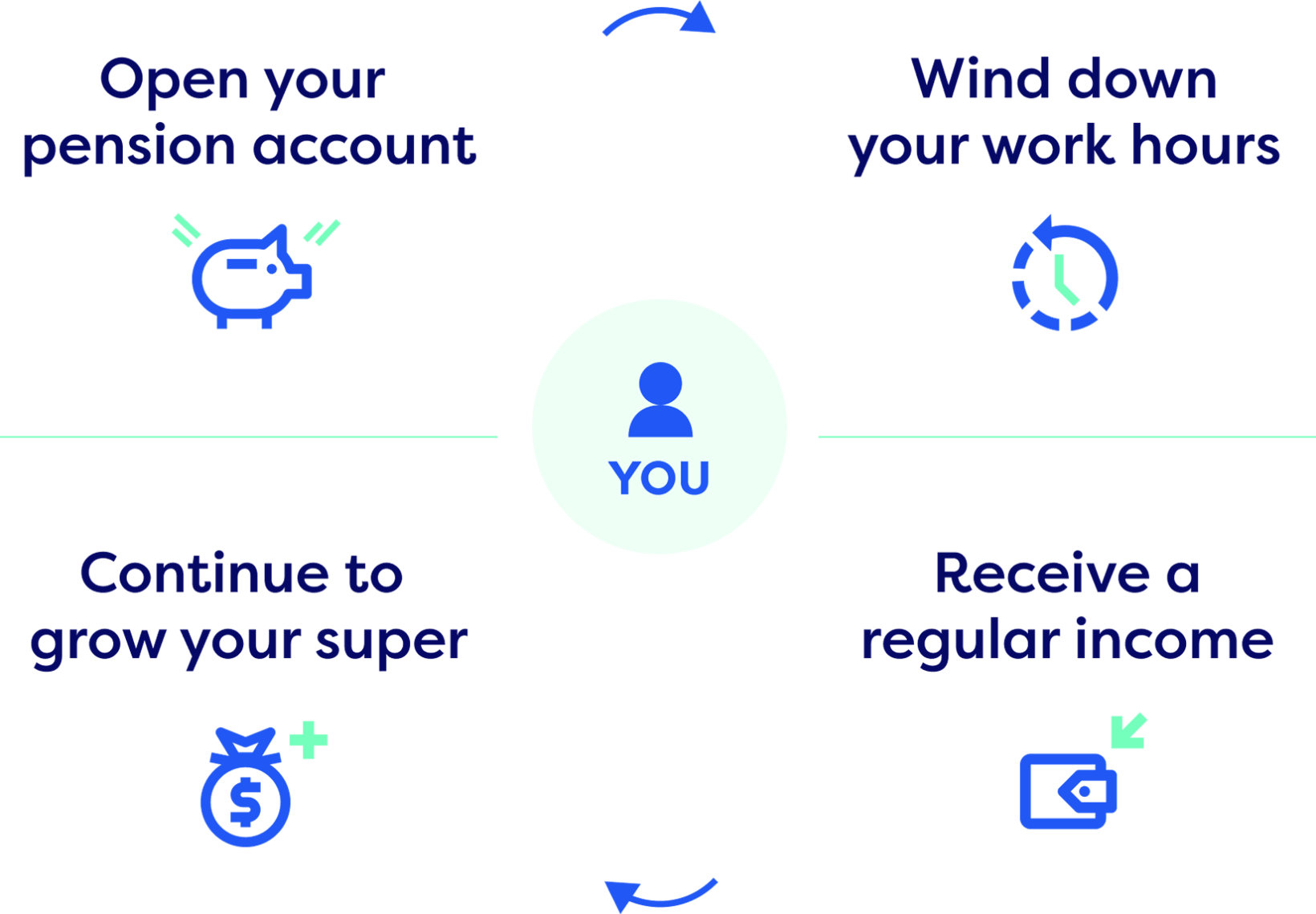

Transition to retirement pension

Start using your super with a transition to retirement pension

A transition to retirement (TTR) pension gives you choices when it comes to gaining access to your super. It lets you open a CareSuper Pension account so you can start drawing on some of your super, while you’re still working and boosting your super savings ahead of retirement.

Let’s see what a transition to retirement pension is all about.

What is a CareSuper transition to retirement pension?

If you’ve reached your preservation age and are still working part-time (at least 10 hours per week) or full-time, you can access your super and start a TTR account.

What are the benefits?

Enjoy:

- Supplemented income – top up your take-home pay with super, as you slowly wind-down your workdays or hours

- Tax savings – there’s no tax on your income payments once you reach age 60 and you can lower the income tax you pay by continuing to top up your super

- Investment earnings – your super will continue to earn you interest (taxed at up to 15%), helping to boost your account balance.

Who can open a CareSuper TTR pension?

Anyone who's:

- Reached their preservation age

- Under age 65, and

- Still working.

Let's plan together

If you're planning for a life after work, seeking financial advice through your super is a great option. We offer 3 different types of advice, based on your individual circumstances. Book a call-back.

We're here to help

If you have a super, retirement or pension-related question, call 1300 360 149, 8am-8pm (AET) weekdays, or get in touch online.