CareSuper’s investment performance 2022/23

A year of strong performance

The 2022/23 financial year was a positive one for our members with most of our options recording strong gains. Our Balanced (MySuper) option’s result was 9.05% for super members and 9.59% for pension members for the financial year ended 30 June 2023.

These are great results considering the economic uncertainty during the past financial year.

While we're pleased to report a strong positive 1-year return, it’s important to remember that super is a long-term investment which can be impacted by short-term ups and downs in market conditions like we've seen in recent years.

View our full investment returns for all options.

Watch our end of year investment update by our Chief Investment Officer Suzanne Branton.

Drivers of returns

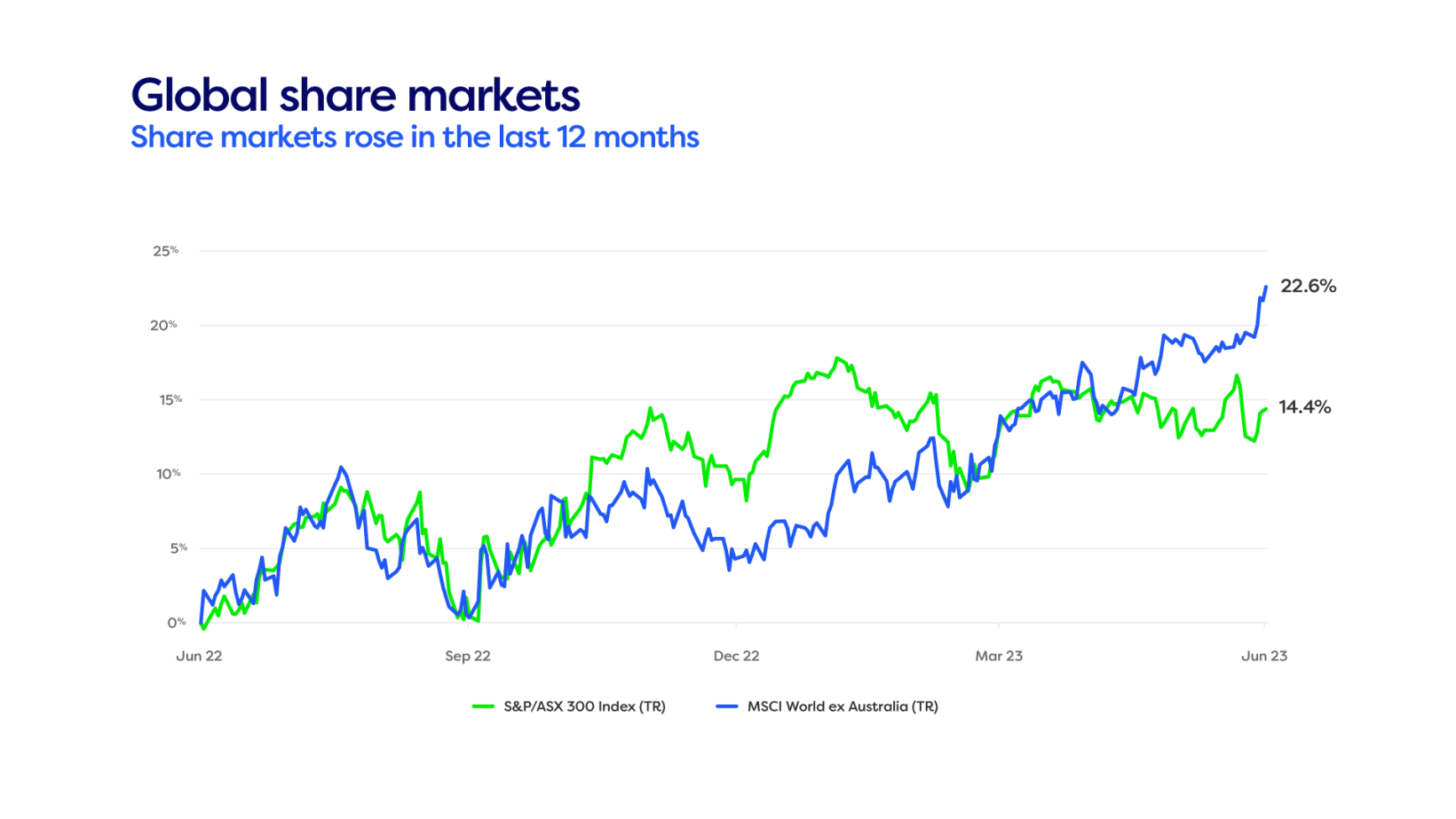

Both overseas and Australian shares performed really well over the year, while returns from other investments such as fixed interest and direct property were more muted.

Shares did well despite rising inflation and interest rates, which typically have a negative impact on share markets.

Overseas shares returned over 20% for the financial year, led by strong US tech stocks and excitement about artificial intelligence. The Australian share market also delivered robust returns of over 14%, primarily driven by strong demand for resources and commodities. As a result, options with higher allocations to shares performed better.

And while shares were the standout, some of the other investments in our diversified options such as credit and infrastructure also performed well.

By contrast, interest rate-sensitive investments like fixed interest and direct property had a more challenging year. So options with higher allocations to fixed interest saw modest positive returns, while those heavily invested in direct property experienced small negative returns. The factors that affected property returns were mainly higher interest rates and reduced demand for office and retail properties as people’s work and shopping habits changed after the pandemic lockdowns.

One of the best defensive investment strategies is to diversify investments across a mix of asset classes, and the past financial year has provided another example of the benefits of a well-diversified portfolio.

Our investment approach has always focused on diversification and active management, allowing us to navigate through various market cycles and past downturns successfully. We firmly believe in protecting our members’ savings’ as super is a long term investment.

Strong returns with less risk

A key part of our investment approach is to protect our members’ savings during times of market volatility and uncertainty. Delivering strong returns with lower risk is a big challenge, and it’s one that our Investments Team keeps achieving year after year. As a result, we’re widely recognised in the industry for this achievement.

For example, we’re ranked number 1 by SuperRatings in the risk-adjusted survey across all long timeframes.* This is in recognition of how we carefully balance the risk we take when investing to achieve strong returns for our members.

We’ve also proudly received the 2023 Smooth Ride award from SuperRatings.^ This award recognises our measured approach to investing and how we achieve strong results while protecting our members’ money when markets are volatile.

Keeping a long-term focus

When it comes to assessing the performance of your super, the most crucial factor you should keep in front of mind is the importance of adopting a long-term view.

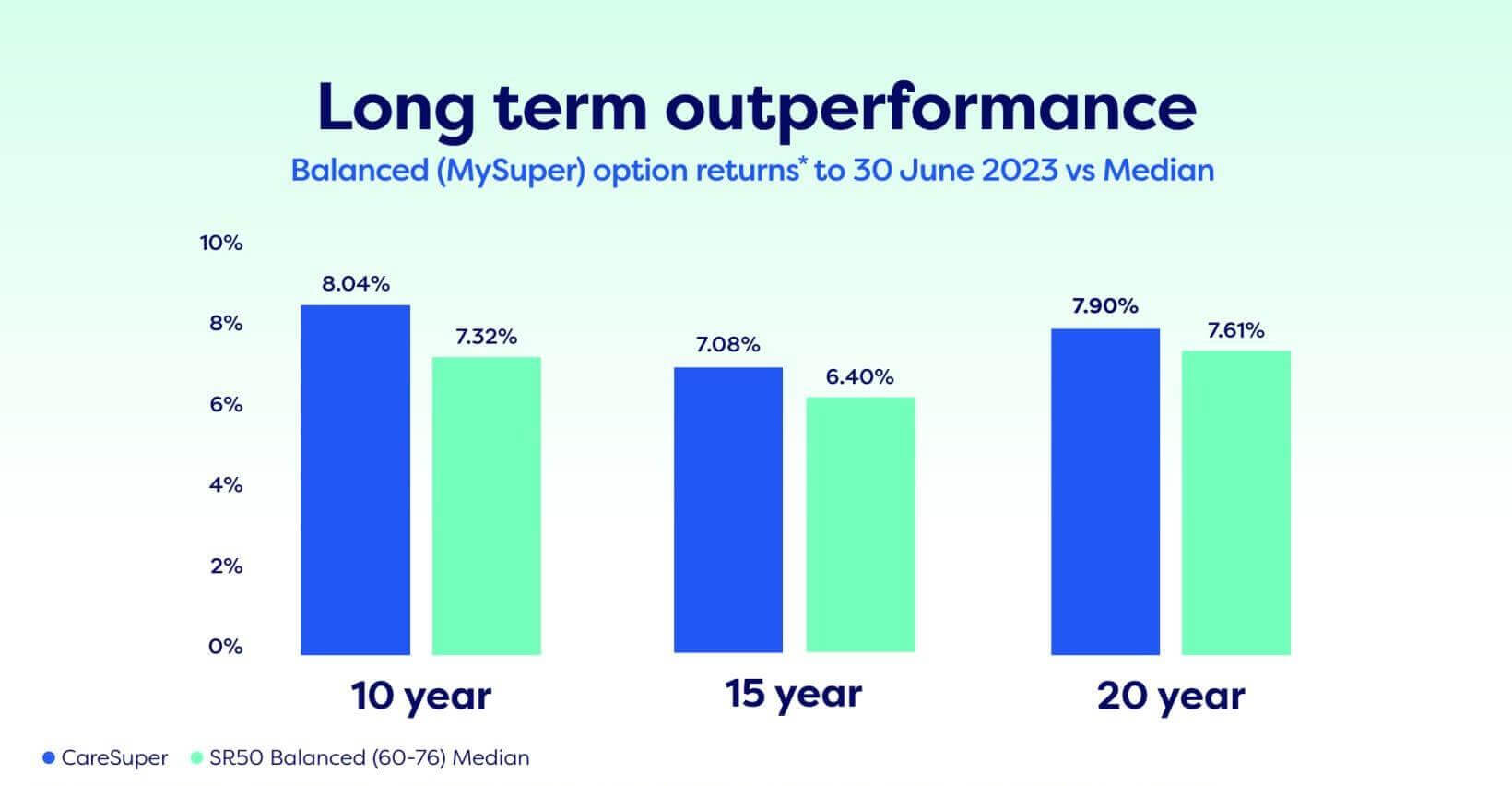

Our Balanced (MySuper) option has delivered an average return of 8.04% every year over the past decade, which puts us in the top 10 performing funds in Australia according to SuperRatings.*

The Balanced option also performed strongly over 15 and 20 years and was also in the top 10 over these periods.

*CareSuper's returns are compound average annual returns. CareSuper returns are net of fees and taxes. Returns have been rounded to two decimal places. Source: SuperRatings Fund Crediting Rate Survey - SR50 Balanced (60-76) Index, June 2023. Past performance is not a reliable indicator of future performance and you should consider other factors before choosing a fund or changing your investments.

Looking ahead

As we reflect on the strong returns of the past financial year, there are important factors we need to carefully consider for the road ahead.

These include the interest rate cycle, and the question of when central banks might be able to bring rates down, how far inflation will reduce and whether the slowing global economy will prove damaging to company earnings.

Given the uncertain environment that we continue to face, our focus remains on effectively executing our active approach and leveraging our deep experience across the cycles.

We expect challenges and opportunities – and we’re confident that we can continue to invest to the advantage of our members over the long term.

We know our members continue to face pressures with the rising cost of living and we can reassure you that our team of investment professionals are actively working to protect your balance while maximising returns.

We’re always looking to your future and we’re here to give you real growth over time, so you can enjoy years of income from your super.

Need help with your investments? We’ve got you covered.

You can check out how your super performed this year by logging in to your MemberOnline account. We'll also be sending annual statements to members soon – find out when you can expect yours.

If you’d like to review your investments with a financial planner you can book an appointment to have an investment review.

For any other questions, get in touch with us.

CareSuper’s performance figures shown are net of investment fees, indirect costs and tax and have been rounded to two decimal places. Past performance is not a reliable indicator of future performance and you should consider other factors before choosing a fund or changing your investments.

*SuperRatings Fund Crediting Rate Survey - SR50 Balanced (60-76) Index, June 2023.

^Product ratings are only one factor to be considered when making a decision. SuperRatings does not issue, sell, guarantee or underwrite this product. Go to www.superratings.com.au for details of its ratings criteria.