Contribution splitting

The calories don’t count when you split a dessert, life’s essentials are better when shared. You share lots of things with your partner, why not share your super?

If you contribute to your partner’s super, the contribution is split (before-tax), and transferred from one super account to the other.

Benefits

Contribution splitting with a spouse or partner can be done once a year after the financial year. The main benefits to this are:

Maximise your partner’s super

Retiring with similar super balances not only makes things more equal, it can help make estate planning easier and potentially include some tax savings.

Access more of the Age Pension

If one of you has a higher super balance than the other, it may impact how much of the government Age Pension you can access.

Earlier access to super

If your spouse retires before you, they can access their super which may be earlier than if you waited.

How it works

- Only before-tax (concessional) contributions made during the previous financial year can be split with your spouse (subject to the maximum amount). These include any before-tax contributions your employer made, and personal contributions.

- After-tax contributions, amounts rolled over from other funds and government co-contributions are some of the contributions that cannot be split.

- Your spouse must be less than their preservation age or aged between their preservation age and 65 years of age and not permanently retired from the workforce.

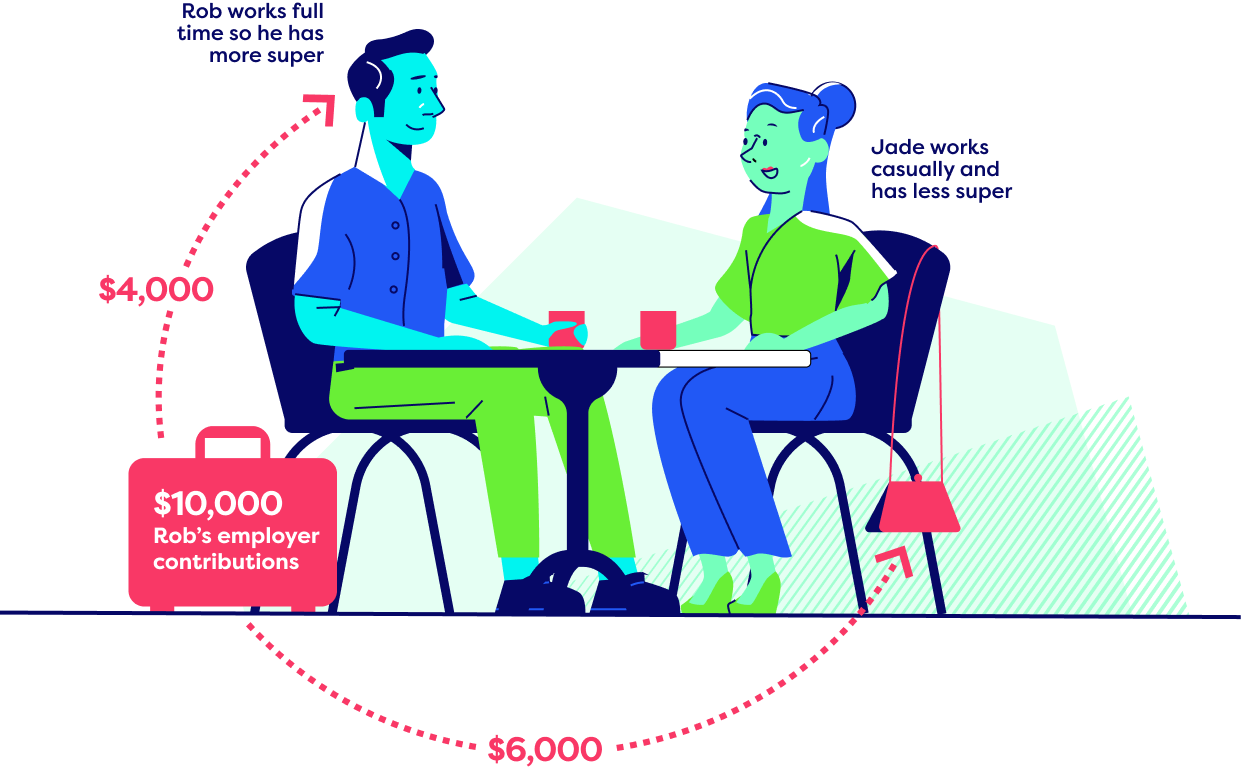

Example:

Rob, 57 works full time and had $10,000 contributed to his super by his employer this financial year. His partner, Jade, 55 works casually, and he wants to boost her super balance by doing a one-off split of his employer contributions into her account. Rob contacts CareSuper who confirm he’s eligible to make the split after 1 July in the new financial year.

In July, Rob completes the ATO’s Superannuation contributions splitting application form, indicating he’d like to split $6,000 of his employer contributions into Jade’s account, and lodges it with us.

Rob’s application is approved because $6,000 is less than 85% of the total $10,000 contributed by his employer and concessional contributions cap. CareSuper transfers $6,000 to Jade’s super fund in September (it may take up to 90 days from application).

Mind the cap

The maximum amount you can be split into your spouse’s super account (in the same fund, or a different fund) is the lesser of 85% of before-tax contributions and your concessional contribution cap, following the end of the financial year in which the contributions were made. In some circumstances, contributions may need to be split in the same year they’re made, such as if you intend to withdraw your super or rollover your account.

Visit the ATO for more information.

Next steps

To request spouse contribution splitting, complete the Contribution splitting form.

Get started using this contribution form

If your partner isn’t a member of CareSuper they can also join and enjoy the benefits of being with a top-performing profit to member industry fund.

Discover why around 220,000 members choose CareSuper^