Members benefit from best performance over 10 years

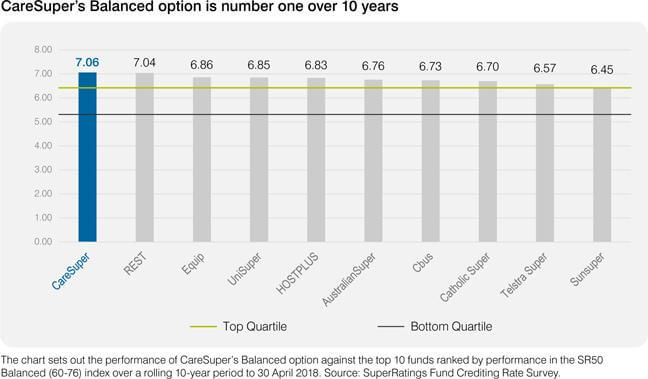

‘CareSuper’s Balanced option was the best performing Balanced option over the past decade,’ says CEO of SuperRatings, Kirby Rappell. In fact, the latest SuperRatings’ report shows CareSuper’s Balanced option average return of 7.06% p.a. is well above the comparable median return of 5.91% p.a.*

‘It’s a great result that shows the importance of a long-term investment strategy that’s in the best interests of members,’ says CareSuper CEO, Julie Lander.

‘We’re aiming to produce strong, reliable returns over long periods, like 10 years, so members can enjoy consistent income in retirement, not just a few good years. We’re not going to be number one every year – and we’re not aiming to be.’

‘We focus on a combination of smart, active investing, and carefully protecting members’ money by minimising the negative effects of volatility – and this report proves our approach is industry-leading.’

- Find out about our other awards, including MySuper of the Year for 2018 from SuperRatings and our 5-star rating from Canstar.

Past performance is not a reliable indicator of future performance and you should consider other factors before choosing a fund or changing your investments.

* SuperRatings Fund Crediting Rate Survey – SR50 Balanced (60-76) Index, April 2018.