Responsible investing

Responsible investing

At CareSuper, responsible investing is a core part of our investment program and our active investment approach enables us to review the environmental, social and governance (ESG) credentials of every investment to maintain the highest standards. We ask our investment managers to do the same. This ensures we’ll always remain a strong and sustainable super fund.

Responsible investing explained

Responsible investing, sometimes referred to as sustainable or ethical investing, is an approach to investing which considers ESG factors in investment decision making.

Our approach to responsible investing

Responsible investing is integral to our investment approach. Why? We believe long term returns are positively influenced by investment management practices that are environmentally sustainable, socially responsible and well governed.

As a profit to members super fund, we aim to contribute to a brighter future for our members’ and their communities. View our Responsible Investing Policy.

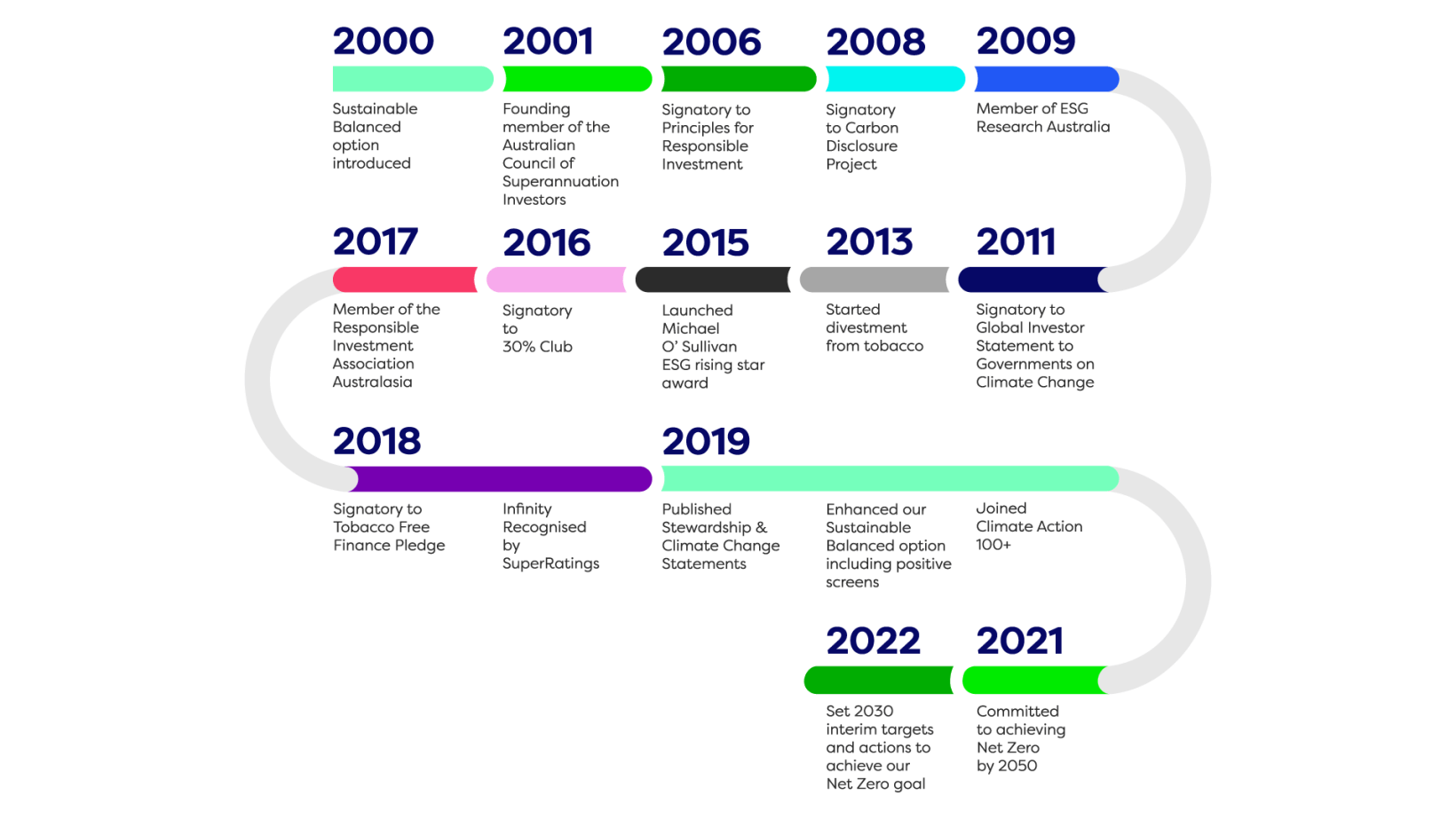

Our responsible investing journey so far

- Assessing the ESG capabilities of investment managers before deciding to invest with them

- Regularly engaging with our investment managers on how they maintain high ESG risk management standards, including requiring them to identify and assess climate change risks and opportunities

- Investing in projects and businesses that contribute to the broader community, including healthcare, renewable energy and new technologies.

We exercise our voting rights at company meetings and use our influence to support positive corporate behaviour and drive improved ESG practices. See our Proxy Voting Policy and voting history.

We work with the following organisations to share knowledge, grow awareness and support ESG initiatives.

| Australian Council of Superannuation Investors (ACSI) | Founding member |

| Principles for Responsible Investment (PRI) | Signatory |

| Responsible Investment Association Australasia (RIAA) | Member |

| Climate Action 100+ | Signatory |

| 30% Club | Member |

| Tobacco Free Finance Pledge | Signatory |

| Australian Asset Owner Stewardship Code | Signatory |

| Investor Group on Climate Change (IGCC) | Member |

We participate in the annual Principles for Responsible Investing (PRI) reporting framework and measure our responsible investing activities against the results of this report. Read the latest report.

Award-winning care