Fee changes

Key changes

All financial services organisations, including super funds, need to comply with new disclosure requirements set out by the Australian Government by 30 September 2022. ASIC has issued guidance on the new requirements, which is referred to as ‘RG 97 Disclosing fees and costs in Product Disclosure Statements (PDSs) and periodic statements.’

You can view ASIC’s regulatory guidance here.

What this means

We’re changing the way we present and calculate certain fees and costs in our PDSs and statements, to adhere to the new requirements. The amendment will create a uniform approach to how super funds display their fees and costs, allowing members to easily compare fees and costs across funds.

Our amended PDS documents due to be released on 30 September 2022, and our annual member statements for the 2021/22 financial year, will show our fees and costs in the new prescribed format.

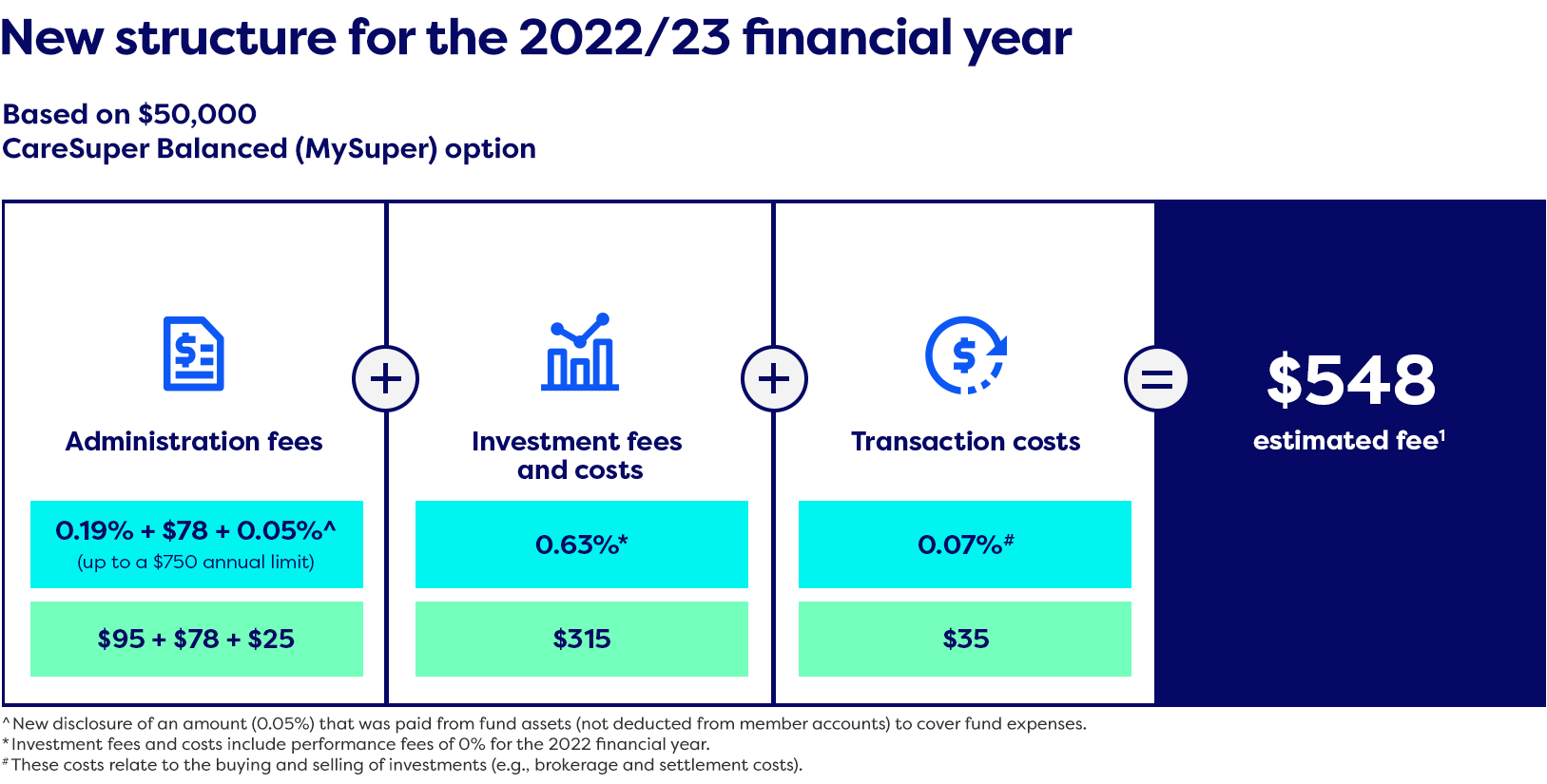

The update will involve the following changes to the PDS:

- New disclosure amount of 0.05%, that was paid from fund assets (not deducted from member accounts) to cover fund expenses

- Investment fees will now be known as ‘Investment fees and costs’

- Indirect costs will now be included in the calculation of ‘Investment fees and costs’ and will no longer be shown separately

- Transaction costs (while not new) will now be shown separately. These costs relate to the buying and selling of investments (e.g., brokerage and settlement costs) and were previously reflected in the ICR

- The performance-related component of the investment fees and costs (where relevant) will continue to be included in ‘Investment fees’ and will now also be shown as a separate amount. The performance-related fees shown in PDS documents will be calculated and averaged over a 5-year period.

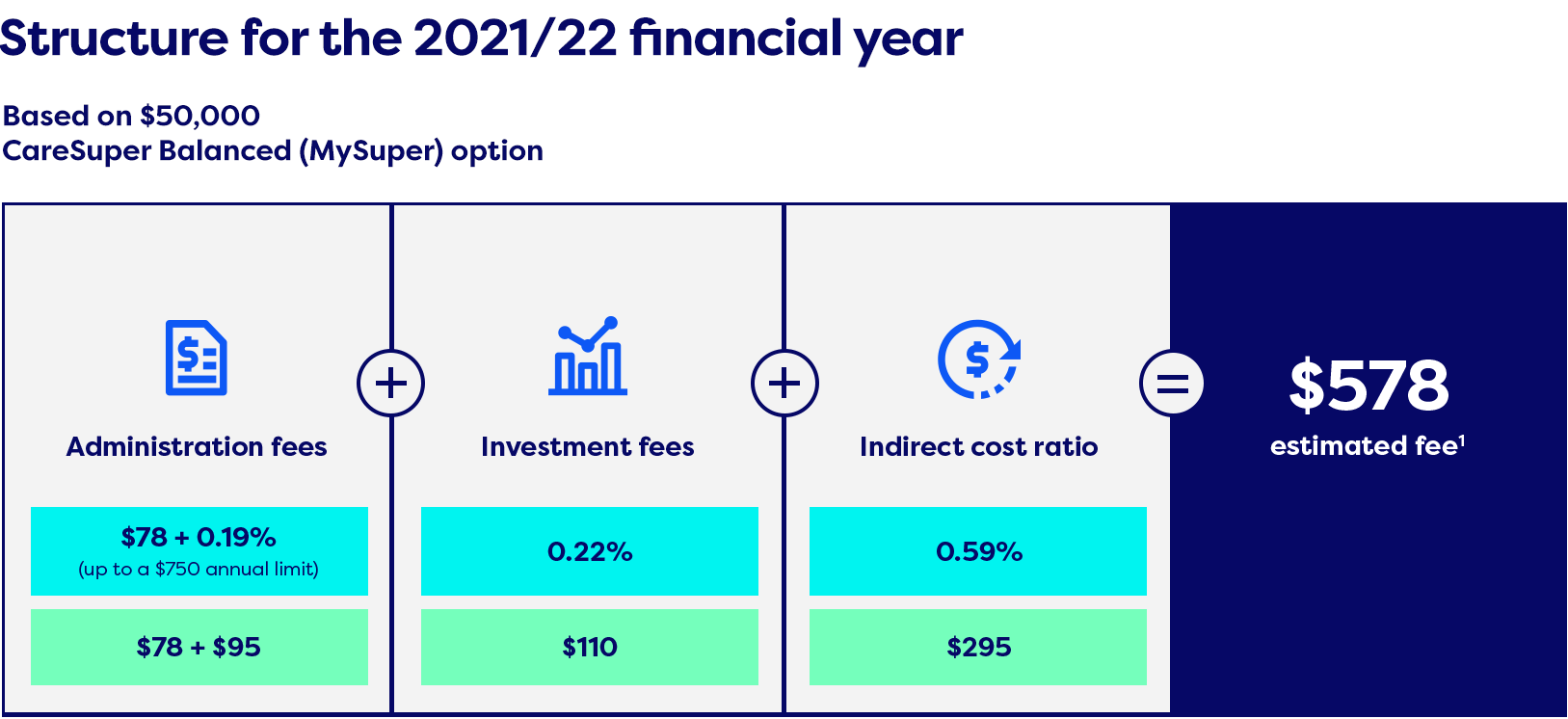

To illustrate these changes, here’s an example of how the changes will apply to the presentation and calculation of our Balanced (MySuper) option, with an account balance of $50,000:

How this affects you

You won’t be adversely affected - the fees and costs incurred by your account won’t change as a direct result of these updates. In fact, these fees have always existed and have been factored into your net-of-fee investment returns. We’re simply changing the way they are calculated and displayed to comply with new industry requirements.

We work hard to keep our fees low

But while we’re talking fees and costs, we do have some good news for our many members invested in our Balanced (MySuper) option. Our investment fee for the 2021/22 financial year (including ICR and transaction costs) of 0.81%, will reduce to 0.70% for this financial year (investment fees plus transaction costs). You’ll see this illustrated in the examples of this new fee structure, which shows a reduction of $30 p.a. (based on $50,000 invested in our Balanced (MySuper) option).

This is a great result for our members invested in this option, and reflects the benefits of our active investing approach, achieving fee reductions through:

- Actively negotiating fees with our fund managers to ensure they’re appropriately aligned with our expectations

- Maintaining an active investing approach by closely monitoring manager performance and replacing those unable to justify their fees

- Leveraging relationships with our key fund managers, working collaboratively to reduce fees.

It’s important to note that at CareSuper, our investment fees and costs go to the external fund managers used to deliver the strategy – we don’t profit from these fees. And while our focus is on net benefit, we also work hard to keep these fees low (and they can change from year-to-year).

We’re here to help

You can see the new fees and costs from 30 September 2022 at caresuper.com.au/fees or in our PDS.

If you have any questions about these changes, or anything to do with fees and costs, call 1300 360 149 from Monday to Friday, 8am to 8pm (AET), or send us a message at caresuper.com.au/getintouch.

1 These fees are indicative only, based on the latest information available. The fees and costs for subsequent years will vary depending on the actual fees and costs incurred by the Trustee in managing the investment option.