When can I start drawing on my super?

Accessing your super depends on several factors, including your preservation age and whether you've met a condition of release.

Preservation age

Your preservation age is the minimum age you can access your super if you want to wind down work or have retired. This is based on the year you were born and is set out here.

| When you were born | When you can access |

| Before 1 July 1964 | 59 |

| After 30 June 1964 | 60 |

Transition to retirement (TTR pension)

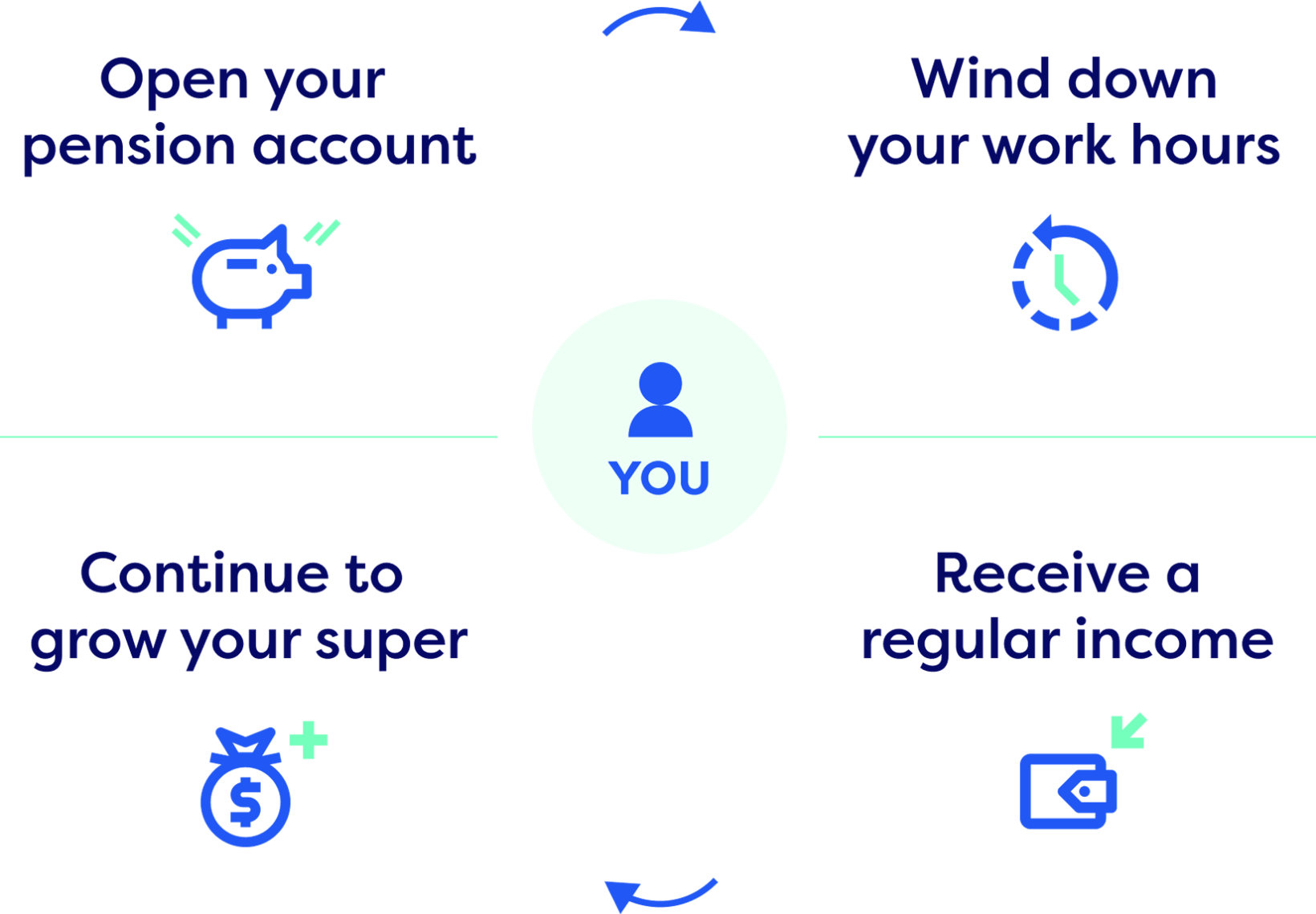

If you’ve reached your preservation age but are still working, you may be eligible to start a transition to retirement (TTR) pension. It lets you open a CareSuper pension account so you can start drawing on some of your super of up to 10% per year. It can be used to supplement your income as you wind-down, or tax-effectively boost your super savings ahead of retirement.

Met a condition of release

Once you meet a condition of release, you generally have access to all your super and can start an account-based pension.

The ‘conditions of release’ include:

- Reach your preservation age and workless than 10 hours per week, or have stopped paid work

- Turn 60 and ceased an employment arrangement

- Turn age 65.

Account-based pension

Retiring doesn’t have to mean the end of your super. You have the option to open a CareSuper account-based pension, which means your investment earnings will now be completely tax free. It enables you to keep your savings invested while you draw a regular income, plus withdraw lump sums when needed. (Be mindful there are some rules around the maximum amount you can hold in an account-based pension, and this is based off the Transfer balance cap.)

Minimum drawdown requirements

Once you start an income stream (a transition to retirement pension or an account-based pension you must withdraw a minimum amount each year based on your age and account balance. Review the ‘minimum and maximum drawdown limits’ on this page.

Understanding the rules and timing of super withdrawals is essential for effective retirement planning. Being informed about your super options will empower you to make financial decisions that will support you throughout your retirement years.

It’s not all on you – we’re here to help

A financial planner can provide you with an estimate of how much super you’ll have when you retire and the income that will provide. If you want more comprehensive retirement income advice you can book in to see one of our experienced financial planners for a competitive fee.

Information correct as at 12 April 2024.