Super fees explained

In the world of super, the different fees (and the reasons behind them) can be confusing. So, let’s try and unravel what they all mean, and why all funds have fees.

Key learnings covered in this topic

- Understand why super funds charge fees

- The types of fees you may encounter

- How to compare your super fees

- Ways to potentially reduce the fees you pay

1. Super fees shouldn’t be super expensive

Super is one of the most important investments you’ll have in life. Choosing the right fund can mean the difference between a comfortable lifestyle down the track, or one of budgeting and sacrifice. That’s why super funds have a responsibility to invest your money wisely.

To help achieve this, all funds charge fees to cover a range of expenses, including:

- Investment experts – to keep a constant eye on the markets and make informed financial decisions to maximise gains and minimise losses

- Brokerage fees – when shares are bought or sold

- Running costs – expenses relating to running the fund efficiently and responsibly

- Extra member benefits – this includes things like insurance cover.

Industry SuperFunds, such as CareSuper, aim to keep fees low, because our primary focus is on doing the best for you as a member, and making sure your investments are working as hard as possible and delivering maximum net overall benefit... for you. Unfortunately, not every fund thinks like we do.

2. Fees you may encounter in super

It’s normal to want to know more about what you’re paying and why. So here’s an overview of the different fees that CareSuper charges:

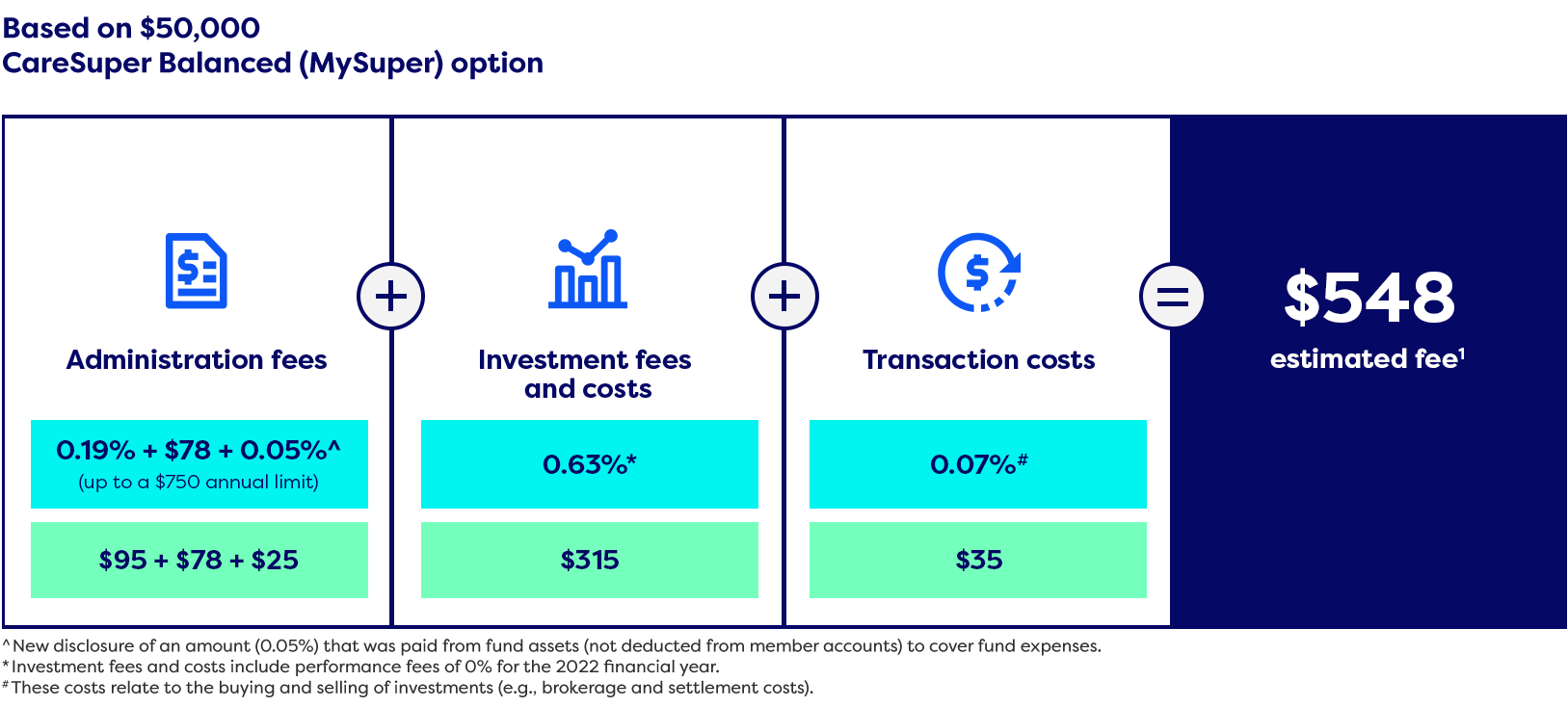

Administration fees and costs

The costs associated with managing and operating the fund, including legislative changes, insurance, overheads and the other costs of running a responsible business. There may be three parts to your Admin fee:

- A flat fee paid out of your super balance each month

- A percentage of your super balance that’s also deducted from your account each month – often up to an annual limit

- A further percentage that may be deducted from fund assets (i.e. not your account)

Investment fees and costs

Meet the costs of investing your super, such as investment managers’ fees (including any performance fees), and the fees charged by individual investment funds that we use.

Each investment option you choose (e.g. Balanced, Growth, Sustainable Balanced) has its own investment fee. The actual fees and costs are calculated each year as a percentage of the money invested in that option. They’re then deducted from the assets of the investment option (rather than directly from your account) and the fees are reflected in the daily unit prices.

Transaction costs

These fees relate to the buying and selling of investments. They cover things like brokerage fees on share transactions, or fees charged if you exit a term-deposit early.

Member activity related fees and costs

You may be charged a ‘buy-sell spread’, which is a fee that’s applied when you transact in an investment option (e.g. by switching investment choices or adding to your super). Buy-sell spreads are not deducted directly from your account but are factored into the unit prices of each investment option.

Insurance fees

If you have insurance cover with us, we’ll deduct insurance fees from your super balance to pay for your cover.

Advice fees

You can get super-related advice over the phone*. At CareSuper, this is part of your membership and is at no extra cost. If you’re after more comprehensive advice^, the fees will depend on the services you’d like help with. At CareSuper, we’ll let you know the fees up front.

Example:

If you have $50,000 in a CareSuper Balanced account (e.g. MySuper), each year you may be charged:

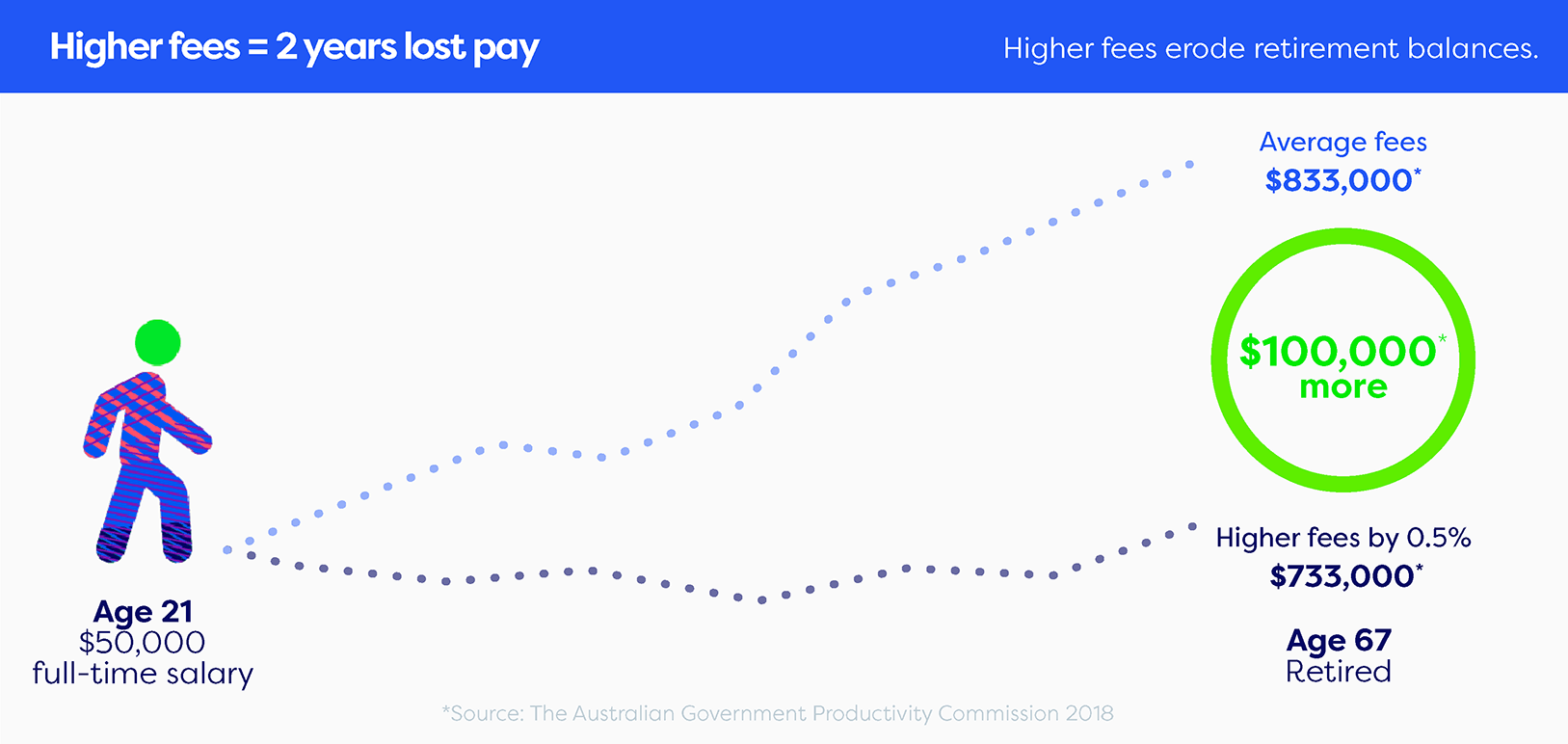

3. Not all fees are created equal

A quick comparison of fees across different funds can often show some big variations in the amounts charged, but why?

Some funds will pay commissions to financial planners to push their products, and this cost will often be covered by charging higher admin fees. As a profit-to-member fund, our financial planners are paid a base salary and no commissions. This allows them to focus on your needs. Learn more about our advice options.

Funds owned by shareholders, like many retail funds, may charge higher fees as they find the balance between generating profits for super members and also generating profits for shareholders. Profit-to-member funds, like many industry funds including CareSuper, return all profits to members and therefore tend to charge lower fees.

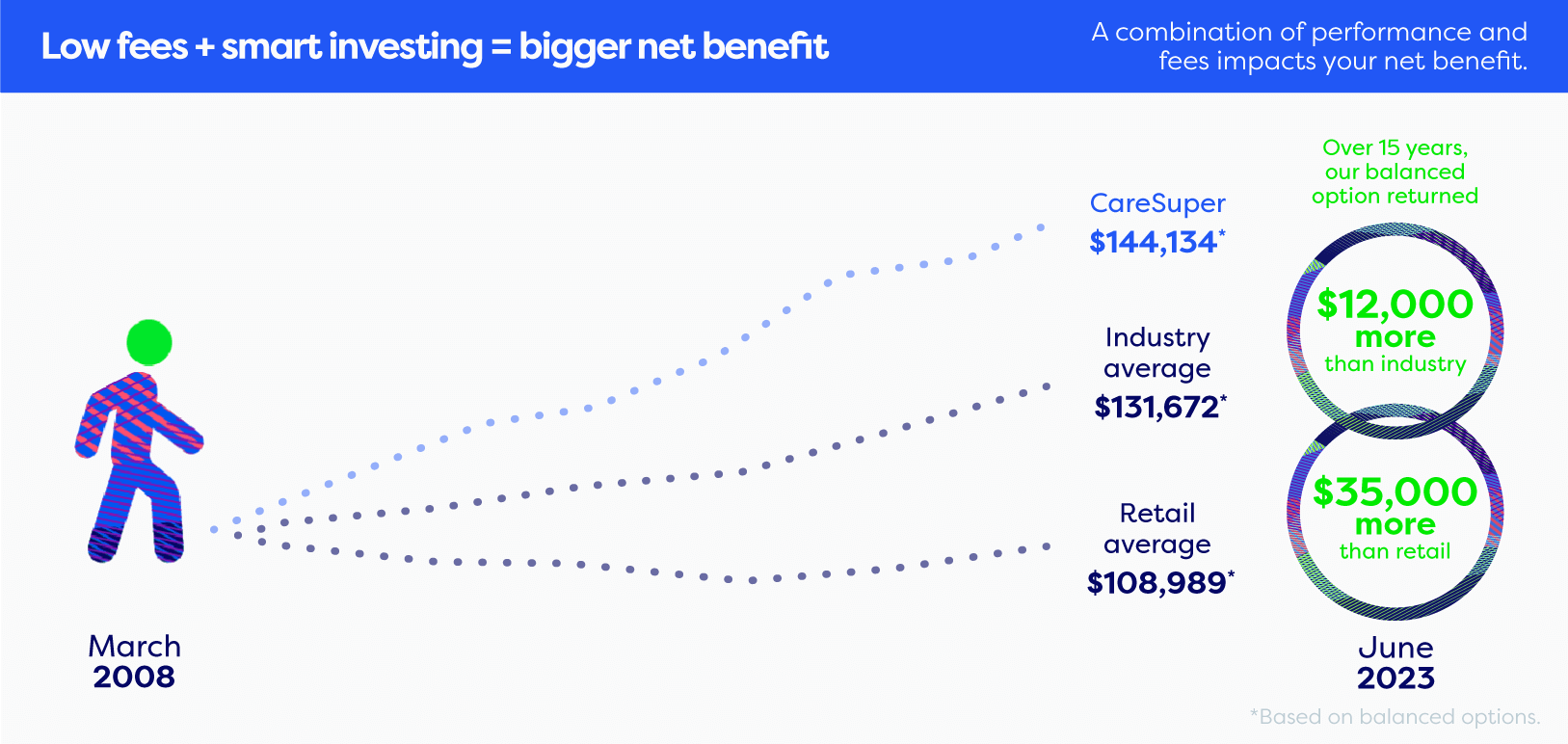

4. Net benefit and fees in super

The amount you pay in fees will, of course, affect the amount of super you have. That’s where comparing different funds’ overall net benefit comes in handy.

In superannuation, net benefit is how much your super increases over time. It’s worked out by totalling your investment earnings, and subtracting fees, taxes, and other charges. What you’re left with is the net benefit, i.e. the amount of money available at that point in time. A higher net benefit over the years leads to more money to live off when you’re no longer working – and it’s a good way to compare super funds.

CareSuper aims to achieve a strong net benefit for our members, so why not take a look at how we compare.

- Past performance is not a reliable indicator of future performance.

- Comparisons modelled by SuperRatings as at 30 June 2023, commissioned by CareSuper.

- Assumes a starting balance of $50,000 and initial salary of $50,000 and considers historical earnings and fees – excluding contributions, entry, exit and adviser fees.

- Compares the average difference in net benefit performance of CareSuper’s Balanced option and the balanced options of funds tracked by SuperRatings including funds with a 15-year performance history.

- Outcomes vary between funds. See caresuper.com.au/assumptions for more details about modelling calculations and assumptions.

- This information is general advice only. You should consider your investment objectives, financial situation and needs and read the product disclosure statement before making an investment decision.

5. Minimise fees, maximise super

All funds charge fees. They wouldn’t last long if they didn’t. But you certainly shouldn’t be paying more than you need to.

There are two key ways to minimise your fees (and keep more of your super):

- Choose a low-fee, profit-to-member fund, with a solid track record of performance. That way you get all the benefits of a more sustainable, rewarding fund, without excessive fees eating into returns, and

- Consolidate your super into such a fund (if this is suitable for you).

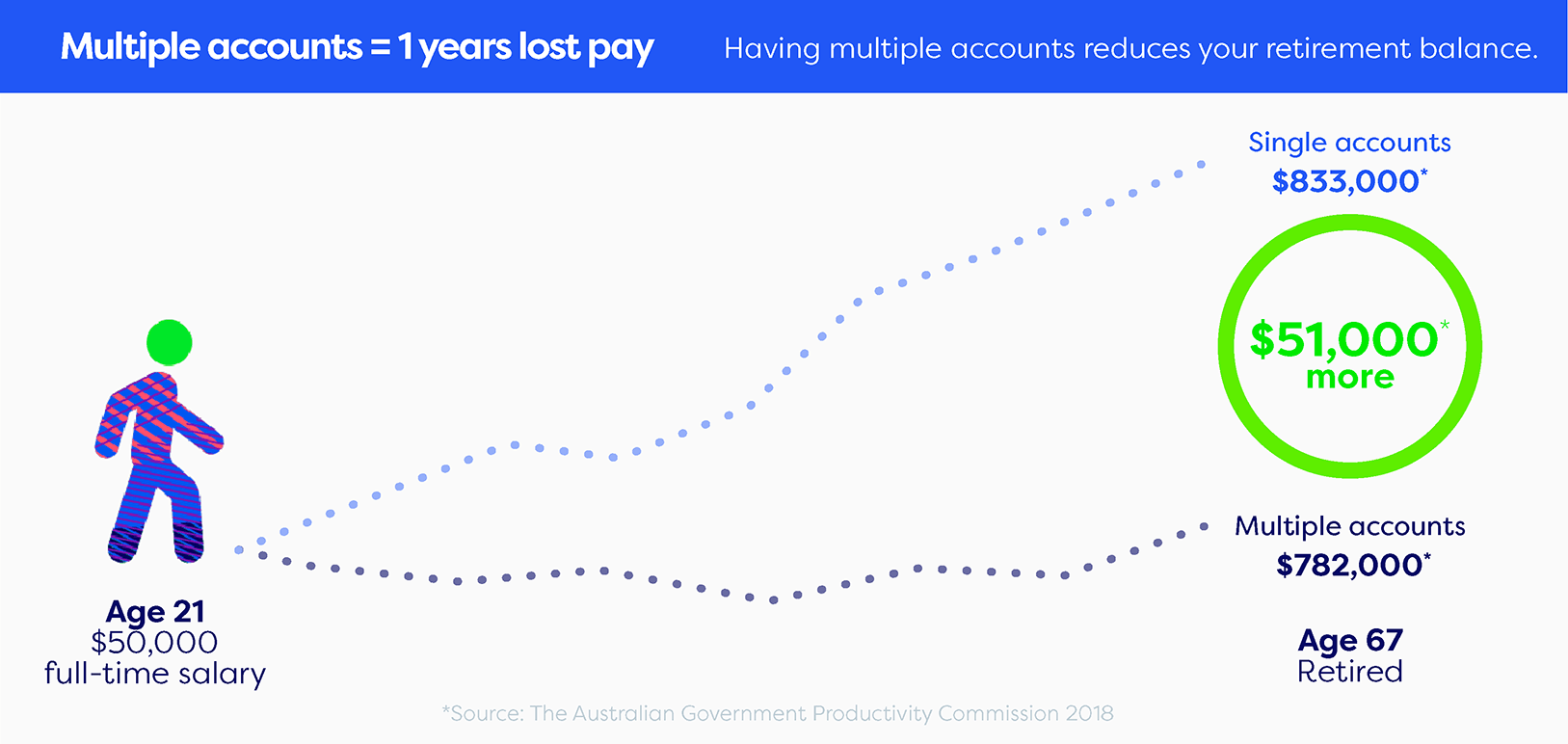

6. Multiple funds means multiple fees

Since every fund will charge you a fee, every super account you have is costing you. But by rolling all your super into one low-fee fund like CareSuper, you’ll only pay one set of fees – and have a lot less paperwork to deal with.

Best of all, most super funds can do all the hard work for you, by looking for old super accounts on your behalf, and consolidating them into one account.

7. Compare fees. Compare funds.

When comparing funds, it’s always important to check the fees charged by different funds. And a great place to start is with a fund comparison tool that gives you side-by-side data on different funds.

So, that’s super fees in a nutshell. If you still have questions, or want to know anything else about super, simply get in touch with us.

Information correct as at 29 November 2023.

*Financial advice obtained over the phone, or through MemberOnline, is provided by Mercer Financial Advice (Australia) Pty Ltd (MFAAPL) ABN 76 153 168 293, Australian Financial Services Licence #411766.

^ Advice is provided by one of our financial planners who are Authorised Representatives of Industry Funds Services Limited (IFS). IFS is responsible for any advice given to you by its Authorised Representatives. Industry Fund Services Limited ABN 54 007 016 195 AFSL 232514.