Tax and your super

Investing in super is one of the most tax-effective ways to save for life after work. Superannuation is generally taxed at a lower rate than other investments or savings. This is to assist Australians like you build retirement savings and incentivise additional contributions, to improve your final balance when you wind down work.

Understanding how tax applies to super is an important step to ensuring you don’t pay more than necessary, and to give you the best chance of benefiting from the tax-effective environment that super offers.

Tax may apply to your super:

- When you or your employer make a super contribution to your account

- If you make a withdrawal from your account

- On the investment earnings on your super investment before they’re applied to your account

- It’s paid to your beneficiaries as a death benefit.

See below where we dive deeper into tax and your super.

Tax on super contributions

The tax you pay on super contributions varies depending on:

- The type of contribution made to your account (whether the contribution was made before or after you paid income tax)

- Whether you’ve notified your super fund of your tax file number (TFN)

- Whether you’ve stayed within or exceeded the contribution caps, and

- If you earn $250,000 or more per year.

Before-tax contributions

These contributions are also called concessional contributions and include super guarantee (SG) contributions paid by your employer, after-tax contributions you make and then claim a tax deduction for, salary sacrifice contributions paid to your super account, or contributions split with a spouse.

Generally, these contributions are taxed at 15% instead of your marginal tax rate, which may be up to 45%.

You can contribute up to $30,000 before-tax contributions to your super account each financial year without incurring additional tax. Any super contributions over this amount are taxed at your marginal tax rate at the end of the financial year (less the 15% tax that you’ve already paid on the contribution).

There are two exceptions to keep in mind:

- If you earn less than $37,000 per year: you might get a tax refund for any tax you’ve paid on super contributions (up to $500), with the refund paid to your super account (this is known as the ‘Low Income Superannuation Tax Offset’ or ‘LISTO’)

- If you earn over $250,000: you’ll likely be responsible for paying an additional 15% tax on some or all of your before-tax contributions. The ATO will advise if this applies to you, and how much you need to pay, after you complete your tax return for the financial year.

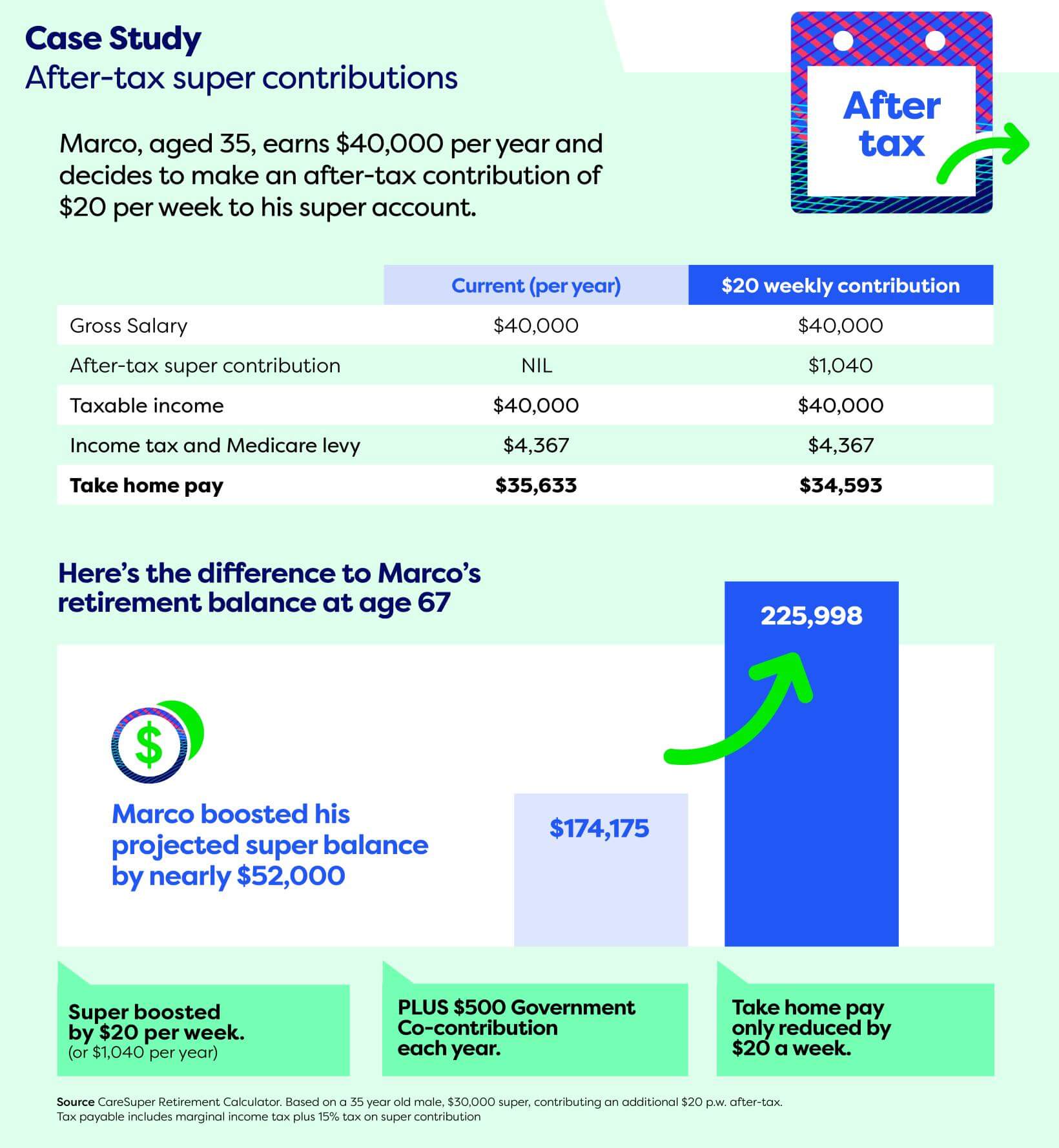

After-tax contributions

These contributions are also called non-concessional contributions and include any personal contributions you make from your take-home pay. (For example, contributions made from your take home pay, cash in your bank account that you contribute to your super, if you receive an inheritance or work bonus).

You won’t incur extra tax on these after-tax contributions, as you’ve effectively already paid tax on this money at your marginal tax rate.

You may be able to contribute up to $120,000 of after-tax contributions to your super account each financial year without incurring additional tax. Extra taxes apply to any after-tax contributions that exceed the non-concessional cap. If your total of all your super balances (as at 30 June of the year before the current financial year) exceeds $1.7 million then your cap will be $0.

Tax on withdrawals

Tax may apply on withdrawals from your super account, depending on your age and the amount withdrawn. Withdrawals from your super account are divided into tax-free and taxable components – regardless of your age, you won’t pay tax on tax-free components.

The amount of tax applicable on taxable components of super withdrawals are as follows:

| Circumstance | Tax rate applicable on withdrawal |

|---|---|

| I’m age 60 or older | All withdrawals are tax free. |

| I’ve reached my preservation age | The first $235,000 (FY 2023/24) is tax free. The remainder taxed at the lesser of 17% (including Medicare Levy) or at your marginal tax rate. |

| I’m under my preservation age (note you need to meet a condition of release to withdraw your super) | Your withdrawal will be taxed at the lesser of 22% (including Medicare Levy) or at your marginal tax rate. |

| I’m claiming a Departing Australia Superannuation Payment | Your withdrawal will be taxed at 35% or 65% if you’re a working holidaymaker. |

Tax on investment earnings

Investment earnings (this is the money your super earns while invested) are taxed at 15 per cent while you’re accumulating super or if you have a transition to retirement pension. Tax is deducted before investment earnings are applied to your account.

Your investments aren’t taxed if you have a full CareSuper Pension (excludes transition to retirement accounts (you’re using your super to provide an income in retirement).

Tax on super payments to beneficiaries

Your beneficiary/ies may be required to pay tax on the taxable component of your super death benefit.

Super on death benefits are taxed differently depending on whether your super’s paid as a lump sum or income stream, and if your beneficiary/ies are considered ‘tax dependants’.

For more information on tax on death benefits, see the Claiming a death benefit fact sheet or visit the ATO >

Tax applicable when you consolidate your super

Generally, you won’t pay tax when you consolidate your super from one account to another.*

Wrap up – 5 tips to avoid paying more tax:

- Ensure your super fund has your (TFN) – CareSuper members can head to the ‘Personal details section’ of MemberOnline to check we’ve got it, or supply it

- Stay within the contribution caps – that’s $30,000 for concessional (before-tax) contributions, and $120,000 for non-concessional (after-tax) contributions

- Maximise the concessional contribution cap: the more before-tax salary you put into your super, the lower your taxable income will be.

- See if you’re eligible to claim a tax deduction on after-tax contributions – this could reduce your assessable income and means your contribution is taxed at 15% instead of your marginal rate. (Be mindful it will count towards your concessional, or before-tax, contribution cap.)

- Seek financial advice - Tax and super can be tricky, so if you have questions, get financial advice to ensure you’re making the best move for your circumstances.

Information correct as at 1 July 2024.