Volatility and my super

We understand that it’s unsettling to see your super balance fluctuate – especially if you’re close to, or in, retirement. However, you can rest assured that during periods of market volatility, our main goal remains to deliver the best financial outcomes for you, over the long term.

We break down what market volatility is and how we manage it to help protect your investments.

Key learnings covered in this topic

- The power of good financial advice

- How CareSuper can help you reach your financial goals.

What is share market volatility is, and why does it occur?

Volatility is when the value of assets changes rapidly over the short-term, which can have an impact on investments like your super. All investments can be subject to volatility – whether they’re property, fixed interest (bonds) or alternatives. But volatility is usually most experienced in relation to share markets.

Ups and downs in markets can occur due to a range of factors such as geopolitical tensions, economic changes such as rising interest rates and inflation, pandemics or other major disasters, and company news and data.

How CareSuper navigates volatility and market cycles

In periods of market volatility, we continue to monitor our portfolio and markets closely. It’s difficult to predict how long volatility will last, but our investment philosophy – that guides how we invest your super – uniquely prepares us for periods of market lows. Our investment strategy is designed to:

- Focus on the long term

- Actively invest for growth – our investment professionals choose every investment we hold and take advantage of opportunities when markets fall

- Mitigate downside risks – to protect your super against losses in volatile times

- Diversify our investments to help manage risks.

We stick to our disciplined investment approach and focus on outperforming over the long-term.

You can read more about our investment philosophy or watch our video on how we invest.

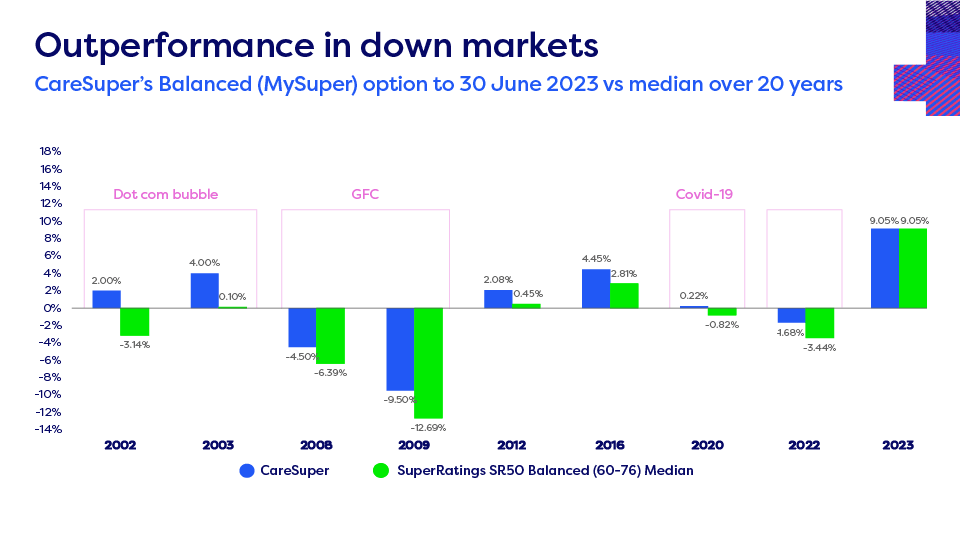

CareSuper’s returns are compound average annual returns. CareSuper returns are net of fees and taxes Returns have been rounded to one decimal place. SuperRatings SR50 Balanced (60-76 Median) Index, June 2023. This survey includes Balanced options for Industry funds and Master trusts. Past performance is not a reliable indicator of future performance, and you should consider other factors before choosing a fund or changing your investments.

5 ways to manage your super during market volatility

1. Log in to MemberOnline

You can review your investments in the ‘Investments section’ of MemberOnline. You’ll be able to see your exposure to the different asset classes.

2. Stay calm

Volatility can trigger emotional responses, but it might not be in your best interests to react to short-term volatility. Switching investment options when markets are low could mean you risk locking in a loss, and missing out on a return should the investment recover.

3. Keep your eye on the long term

While short-term changes in your super balance can be worrying, market fluctuations and investment volatility is a normal part of investing. Whether retirement is near, far, or you’re already living it, it’s important to stay focused on your longer-term goals or future retirement income needs.

4. Understand risk

All investments carry some risk. How much risk you’re willing to accept will be influenced by your financial situation, family considerations, time, and even your personality.

5. Speak to a financial planner

It’s a good idea to frequently review your investment strategy to ensure it aligns to your goals and objectives. If you’re feeling uncertain about how your super’s currently invested, book a call-back with a financial planner to review your investment strategy before making any changes.* They’ll consider things like your age and investment timeframe, risk appetite and your future goals, and can make recommendations for you based on your circumstances. This type of advice is included in your membership, so there’s no additional cost to have an investment review. ^

Information correct as at 5 February 2024.