A comfortable retirement for singles

If retirement for you looks like meals out, top-tier private health cover and sipping cocktails on holiday at least once a year, you may want to consider how much super you’ll need — especially if you’re flying solo.

In this article, we’ll explore

- What a ‘comfortable’ retirement means

- How much super you need for your ideal lifestyle

- Discovering what ‘comfortable’ looks like for you

- Ways to boost your super

- Seeking financial advice.*

We’ll share some helpful guidelines on what your comfortable retirement might look like. Plus, we’ll help you discover how much you’ll need to enjoy your comfortable lifestyle — and how you can get closer to achieving it.

What is a ‘comfortable’ retirement?

The answer: It depends. Your ideal life after work, and what you consider ‘comfortable’ is unique to you. Super can provide you with the retirement you’ve always dreamed about. So, how do you make it happen? A great place to start is understanding how much super you might need to save over your working life. Here’s a couple of guidelines to get you started.

The two-thirds rule

As a general guideline, you’ll need around two-thirds of your pre-retirement income to maintain the same lifestyle when you wind up work.† In other words, you’ll need around 67% of your yearly income for each year you spend in retirement. For example, if you earn $80,000 a year, you’ll need about $54,000 for each year in your retirement.

It’s because living in retirement is usually cheaper than when you’re working — especially if you’ve already paid off your house. Plus, you may also be able to enjoy certain seniors discounts or even all the benefits of a Seniors Card!

Breakdown: How your retirement could look

Picture this: You’re single, between 65 and 84 years old and own your own home. According to ASFA, you’ll need around $50,000 a year to live comfortably.# With this, you’ll be able to buy groceries and transport, as well as private health insurance, fun times out, and even the occasional holiday.

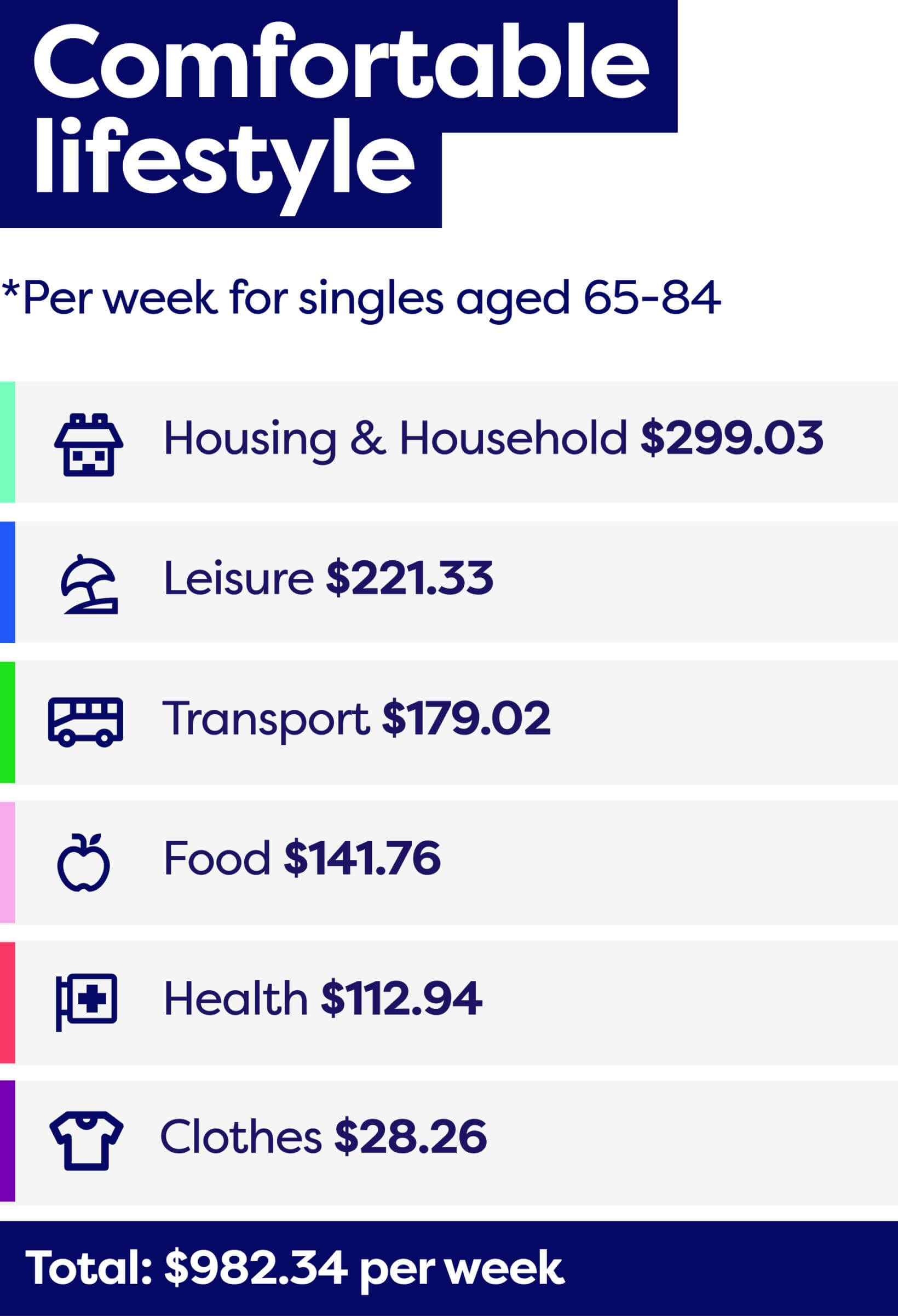

Here’s what it looks like broken down by category.

The figures in this chart are from ASFA’s Retirement Standard and are updated quarterly to reflect changes to the Consumer Price Index. These figures are for the December quarter of 2023 and have been rounded to the nearest dollar.

The figures shown above are costs per week but equate to $51,278.30 per year.#

What this looks like in terms of your super balance

It means if you retire at 67, you’ll need a super balance of around $595,000^ to see you through your golden years comfortably.

Remember, these figures also assume you own your home when you retire. If you don’t, then you’ll need to add rent or mortgage repayments on top of these amounts.

Discover your ‘comfortable’

You’re unique, and how much you need in retirement depends on the lifestyle you want to live.

You can find out what ‘comfortable’ looks like for you — and how much super you’ll need to achieve it — by using our Retirement Income Calculator. It’ll provide an estimate of your future income in retirement, and help you understand what you need to do to achieve the lifestyle you want.

Boost your super now so you’re comfortable later on

Salary sacrifice

This empowers you to contribute extra to your super from your pre-tax salary. You can set up an arrangement with your payroll department so this happens automatically each pay cycle on top of your employer’s super guarantee contributions.

The big advantage can be the tax savings. Instead of paying tax at your marginal rate, you’ll pay only 15% tax (the tax payable on your concessional contributions may be greater if your total income and concessional contributions for the year is more than $250,000 per year). You just need to make sure you don’t go over the concessional contribution cap as then you’ll be taxed at your marginal tax rate.

For example, let’s say you earn $80,000 per year. If you salary sacrifice $100 a fortnight into your super, you’ll be adding an extra $2,600 a year to your super balance. Plus, it means you’ll also save on tax.

Personal after-tax contributions

You can boost your super from your after-tax salary, either as a one-off contribution or a regular, ongoing payment through your employer or financial institution. Again, there is a non-concessional contributions cap to be mindful of. If you go over, you’ll be taxed at the highest marginal tax rate plus the Medicare levy.

The Government co-contribution

If you’re a low-income earner, you may be eligible for a $500 boost to your super from the government. It works on a sliding scale depending on how much you earn and how much you contribute. To be eligible, you need to earn less than $60,400 in 2024/25. There are other requirements that also need to be satisfied to be eligible for the Government co-contribution.

Find out more ways to boost your super.

We’re here to help

Getting your super on track and exploring the best ways to grow your super doesn’t have to be a solo journey. We have lots of resources available and we’re here to help. You can speak with one of our financial planners — it’s covered by your membership and won’t cost any extra.*

Book a call-back.

This article forms part of our Super for singles series. You can also read our Insurance for singles and Nominating beneficiaries for singles articles.

Information correct as at 1 July 2024.

*Financial advice obtained over the phone, or through MemberOnline, is provided by Mercer Financial Advice (Australia) Pty Ltd (MFAAPL) ABN 76 153 168 293, Australian Financial Services Licence #411766.

†How much super you need.

^ ASFA Retirement Standard Summary - 2023.

# ASFA Retirement Standard Detailed Budget Breakdowns – December 2023.