Transition to retirement

Still working but thinking about winding down? You've landed in the perfect place to explore your next steps.

Although super is designed to support your post-work lifestyle, you may be able to access some of it while you’re still working by using a Transition to Retirement (TTR) strategy.

Key learnings covered in this topic

- How to use a TTR strategy

- TTR examples

Your pathway to leaving work

There are two main ways to use a TTR strategy once you reach your preservation age:

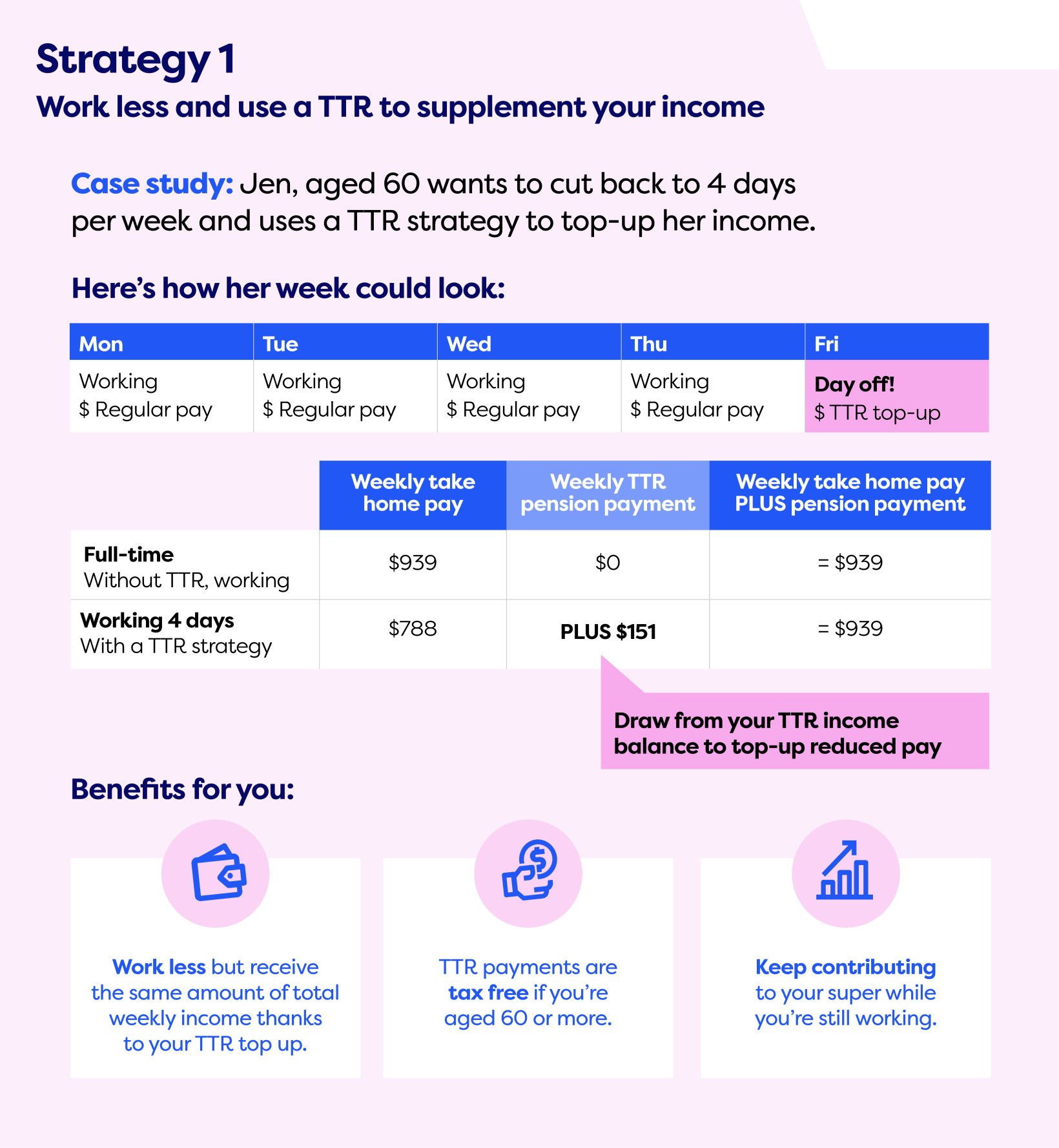

- Reduce your work hours without losing any income (i.e. by using your super to top up your income), or

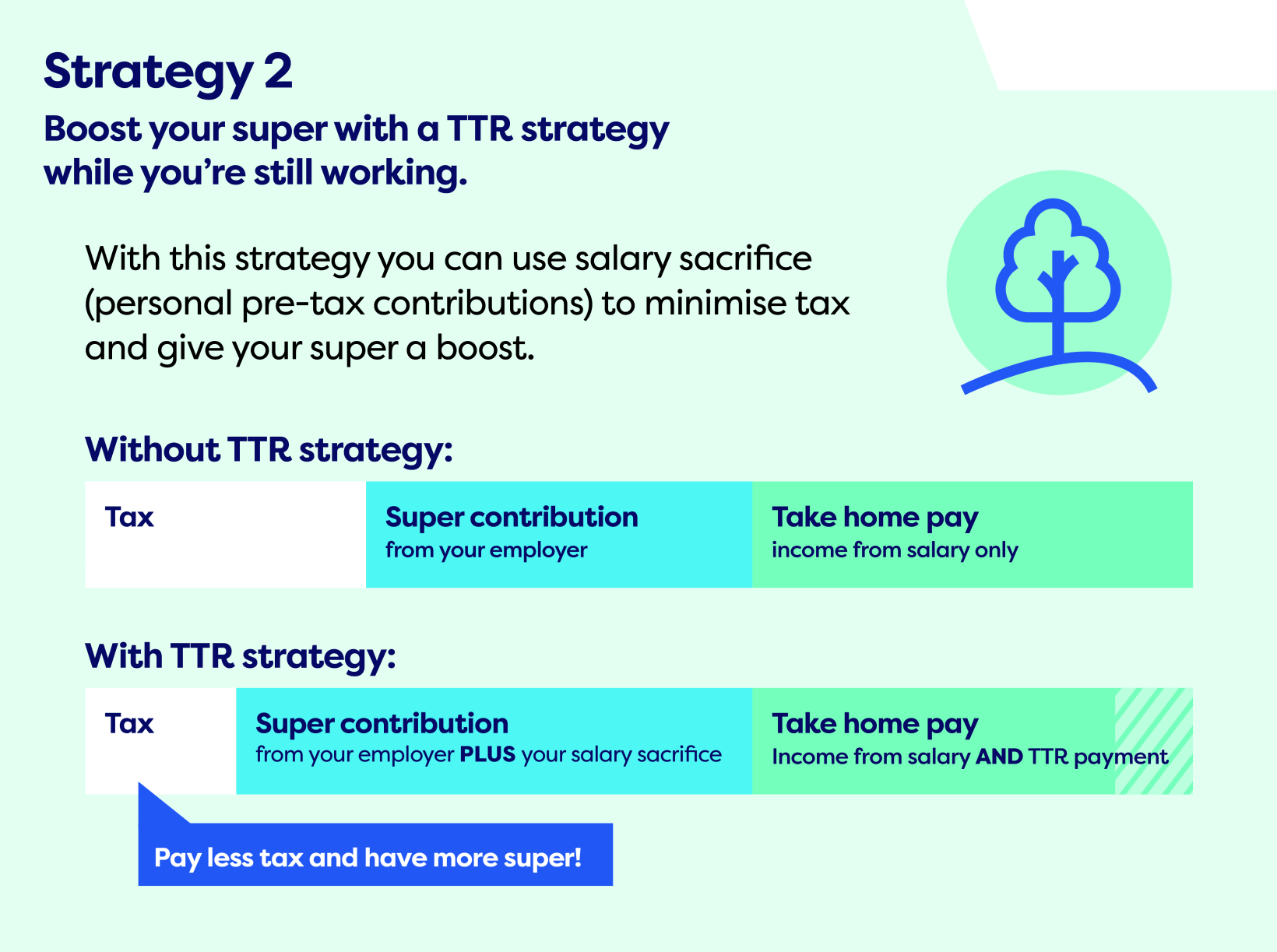

- Save more super (and pay less tax) while you’re still working full-time.

Ready to learn how?

Watch CareSuper’s Financial Advice Manager, Dan Bridgland, break down TTR strategy for you. He’ll also walk you through examples of how a single person and a couple leveraged a TTR strategy to chart their course to life after paid work.

Let’s see how it works

The finer details

We’ve run through the potential benefits of a TTR strategy, but there’s a bit to know about the eligibility requirements, investment and payments. Remember, to open a TTR, you need to have met your preservation age.

- You’ll also need to open your account with at least $10,000 from your super. And each year, your withdrawals have to add up to between 4% and 10% of your total TTR account balance – these are set government limits.

A final note – You’ll have to wait for your 60th birthday for your super payments to be tax-free. A pretty good birthday present, if you ask us! If you’re under 60 there may be other tax considerations. Speak to one of our financial planners to find out more.

For all the info on starting a TTR strategy, be sure to read our Pension Guide PDS and check out the TTR section of our website.

Talk TTR (and more) with a financial planner

Keep in mind the pathway to finishing up work looks different for everyone. Finding the best strategy for your situation can be complicated. That’s why it’s so important to get advice to make sure TTR is right for you. So, if you want to learn more about TTR strategy (and your super in general), our financial planners are here to help at no extra cost.*

Information correct as at 16 November 2023.

*Financial advice obtained over the phone, or through MemberOnline, is provided by Mercer Financial Advice (Australia) Pty Ltd (MFAAPL) ABN 76 153 168 293, Australian Financial Services Licence #411766.