How we protect your super

Market volatility is a normal part of investing, but we know it can be concerning for our members, especially if you’re close to, or in, retirement. That’s why we’re here to ensure your journey to and in retirement is a smoother ride, with less extreme highs and lows.

Key learnings covered in this topic

- How we protect your super in financial market downturns

- What makes our investment philosophy unique

- How we deliver strong long-term returns.

We Outperform and Outprotect

At CareSuper, it’s our investment philosophy that sets us apart from other funds: We aim to Outperform and Outprotect while managing your super.

What does this mean? We’ve built a track record of strong long-term returns without taking as much risk as other super funds.* Our size and agility allow us to build a richer and more diversified investment mix, minimising overall risk and smoothing out the typical highs and lows of the financial markets. We aim to protect your super when markets are falling, giving you the confidence that your savings are in safe hands during good times, and uncertain times.

Delivering strong returns with lower risk

Our dual investment approach is one that has served us well over the years.

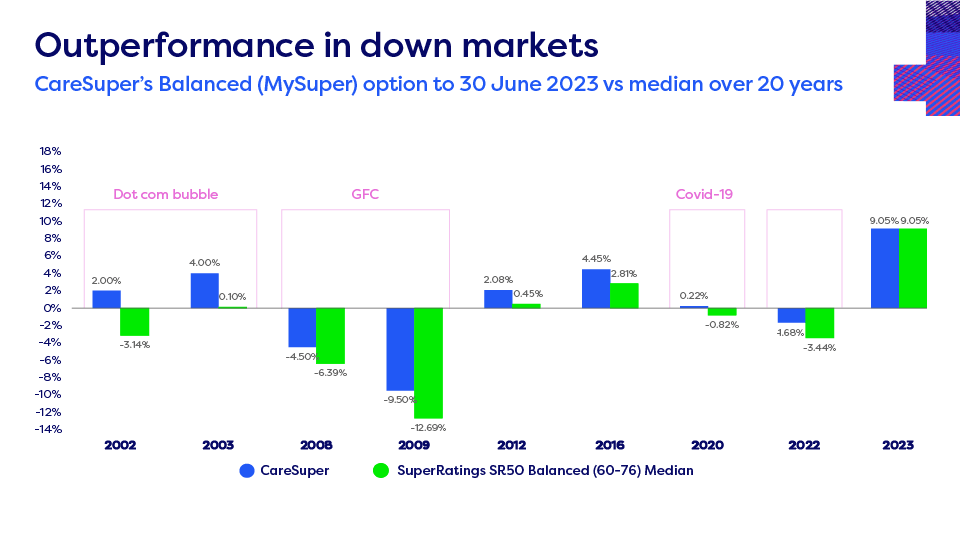

This can be demonstrated through the below graph, which show the highs and lows of the Balanced (MySuper) option and Balanced option (pension) over the last 20 years against the industry median. As shown in the graph, CareSuper has performed well against the industry median in up markets. But notably, our members haven’t suffered as extreme lows as the median fund has in the not-so-good years – such as the Dot Com Bubble, Global Financial Crisis, and COVID-19. In those years, the median fund sometimes delivered significant negative returns. In every case, CareSuper was able to avoid or minimise the financial impact of these crises for our members.

Our investment approach is recognised across the super industry

In 2023 we were proud to receive the Smooth Ride award from SuperRatings.^ This award recognises our measured approach to investing and how we achieve strong long-term results while protecting our members’ money when markets are volatile.

We were also ranked #1 by SuperRatings in its 2023 risk-adjusted survey across all long-term timeframes, in recognition of how we carefully balance risk when investing to maintain strong returns for our members.^

We’re here to help

If you’d like some help with your super investment strategy, remember you have access to financial advice at no-extra-cost to you.# Simply book a call-back or give us a call.

Interested in learning more about how we invest your super? See how we also Outperform your super.

* SuperRatings SR50 Balanced (60-76 Median) Index, June 2022.

^Product ratings are only one factor to be considered when making a decision. SuperRatings does not issue, sell, guarantee or underwrite this product. Go to www.superratings.com.au for details of its ratings criteria.

#Financial advice obtained over the phone, or through MemberOnline, is provided by Mercer Financial Advice (Australia) Pty Ltd (MFAAPL) ABN 76 153 168 293, Australian Financial Services Licence #411766.

Information correct as at 24 October 2023.