Super and the government Age Pension

Your income in retirement can be varied. In addition to your super, you may be eligible for the Age Pension, and other government entitlements to help you meet your expenses in your post work life.

Check your eligibility for the Age Pension

To qualify for the Age Pension, you must satisfy a few key requirements.

Your eligibility can change over time depending on your financial circumstances, so it could be worth checking in with Centrelink regularly. For more detailed information on eligibility requirements go to Services Australia.

Age Pension rates

There are different Age Pension rates depending on your circumstances. The table below shows the basic Age Pension rates for singles and couples each fortnight, as at March 2024*

| Relationship status | Maximum basic Age Pension payment |

|---|---|

| Single | $1,116.30 |

| Couple each | $841.40 |

| Couple combined | $1,682.80 |

| Couple apart due to ill health | $1,116.30 |

*These rates are usually updated every March and September. For more information on how these rates can vary depending on your circumstances, and to see Pension Supplement and Energy Supplement amounts, visit Services Australia.

When you can access your super

You must meet conditions of release to access your super

- Have reached preservation age and working 10 hours or less per week

- Turned 60 and ceased employment arrangement

- Turned 65

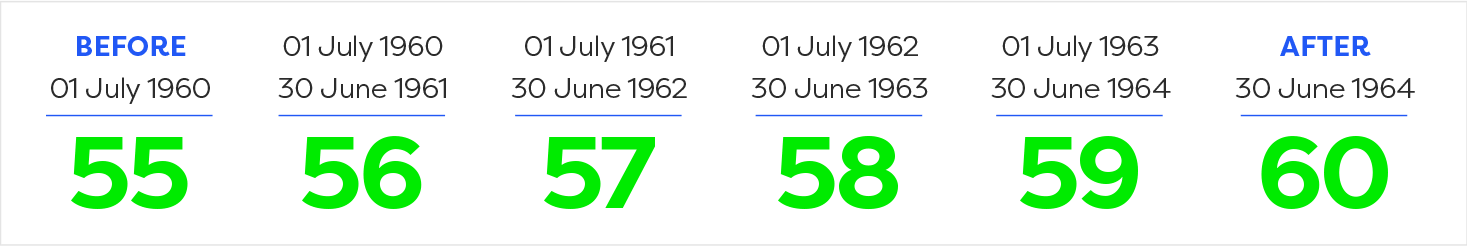

What's my preservation age?

What’s your future income?

See what your future income might look like using our Retirement income calculator.

Other government entitlements

You may be eligible to receive other benefits which can help support your income in retirement.

Pensioner Concession Card

Given to everyone who receives the Age Pension to access cheaper health care, medicines, and discounts on certain government payments.

Commonwealth Seniors Health Card

Available if you’ve reached Age Pension age and if you meet other requirements, including (but not limited to) residency rules and the income test, and gives you access to cheaper health care.

How to apply for the Age Pension

- Apply for (claim) the Age Pension directly through Centrelink.

- Take a stress free approach to applying for the Age Pension through Retirement Essentials. They’re an Australian owned, independent organisation who’ve helped many Australians understand, apply for, and receive all their Age Pension entitlements from the comfort of their own home.

Remember, you have options

When it comes to accessing your super when you finish working, you have options through CareSuper.

With life expectancy in Australia increasing, you might find a transition to retirement (TTR) strategy or an account-based pension, provides a tax-effective opportunity to keep your super savings invested. This might be one consideration. Explore your options with us to see which income account best suits your needs.

Advice when you need it

We understand that planning for life after work can feel overwhelming. Seeking financial advice through your super fund can be a great option and we have several types of advice to suit your needs.