Consolidate your super

Consolidate your super

Losing track of your super is easy to do, especially if you change jobs or move to a new address. We can help you find it and put it in your CareSuper account.*

One account. One set of fees. What’s not to love?

The upside of having one account

- One account means more in your pocket

Multiple super accounts means multiple fees. - Less admin for you

Avoid extra work by managing just one account. - Keep track of your retirement savings

Manage your super savings simply via your online account (so you always know how much you have). - Your super will follow you

Super stapling means your account will follow you from job to job.

-

1Log in

Log in to your MemberOnline account or register here. Once logged in, select ‘Find my super’ in the dropdown menu.

-

2Verify your identity

You’ll need to have two items of identification handy, like your driver licence, Medicare Card or passport to verify your identity.

-

3Search

Then start your search. We'll tell you how many accounts we find (if any), and you decide how much you want to transfer in to your CareSuper account. Simple!

Alternatively, we can assist you over the phone. Call us on 1300 360 149, 8am – 8pm weekdays to speak with a member of our team.

Bring all your super to a top performer over the long term.^

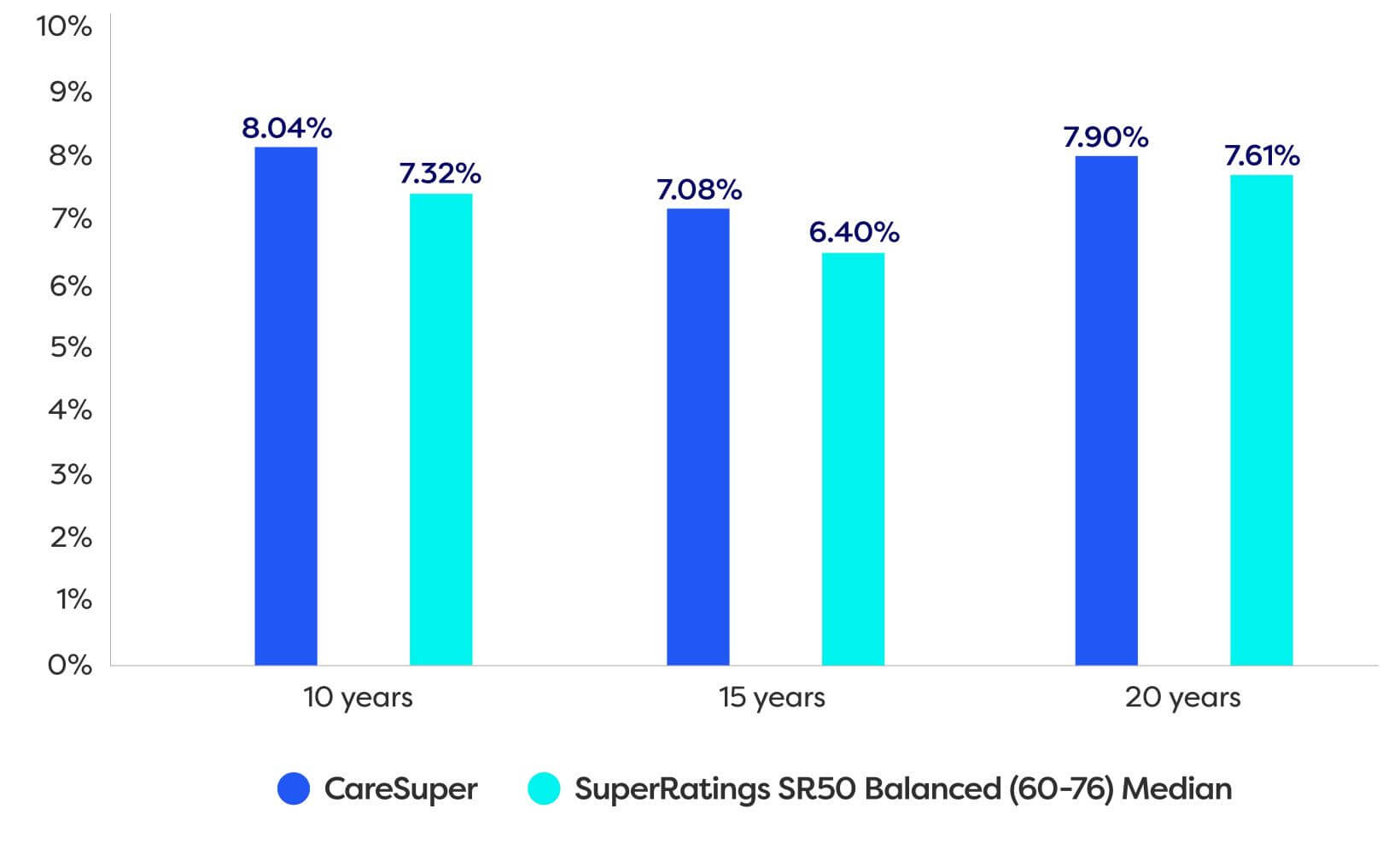

You'll benefit from having all your super with a long-term investment performer. Our Balanced (MySuper) option is a top performer over 10, 15 and 20 years to 30 June 2023.^

Read more about our performance.

CARESUPER'S BALANCED (MYSUPER) OPTION RETURNS TO 30 JUNE 2023

Please note: CareSuper's 10, 15 and 20 year returns are compound average annual returns as at 30 June 2023. CareSuper returns are net of fees and taxes. Returns have been rounded to two decimal places.

^Source: SuperRatings Fund Crediting Rate Survey – SR50 Balanced (60-76) Index, June 2023. This survey includes Balanced options for industry funds and master trusts. Past performance is not a reliable indicator of future performance and you should consider other factors before choosing a fund or changing your investments.

*Before combining your super into CareSuper you should consider whether this is right for you and check if you will be charged any fees. You should also check the impact on any insurance arrangements (such as loss of insurance) or other benefits.