CareSuper Pension – Retire with confidence

Turn your super savings into a flexible and tax effective income

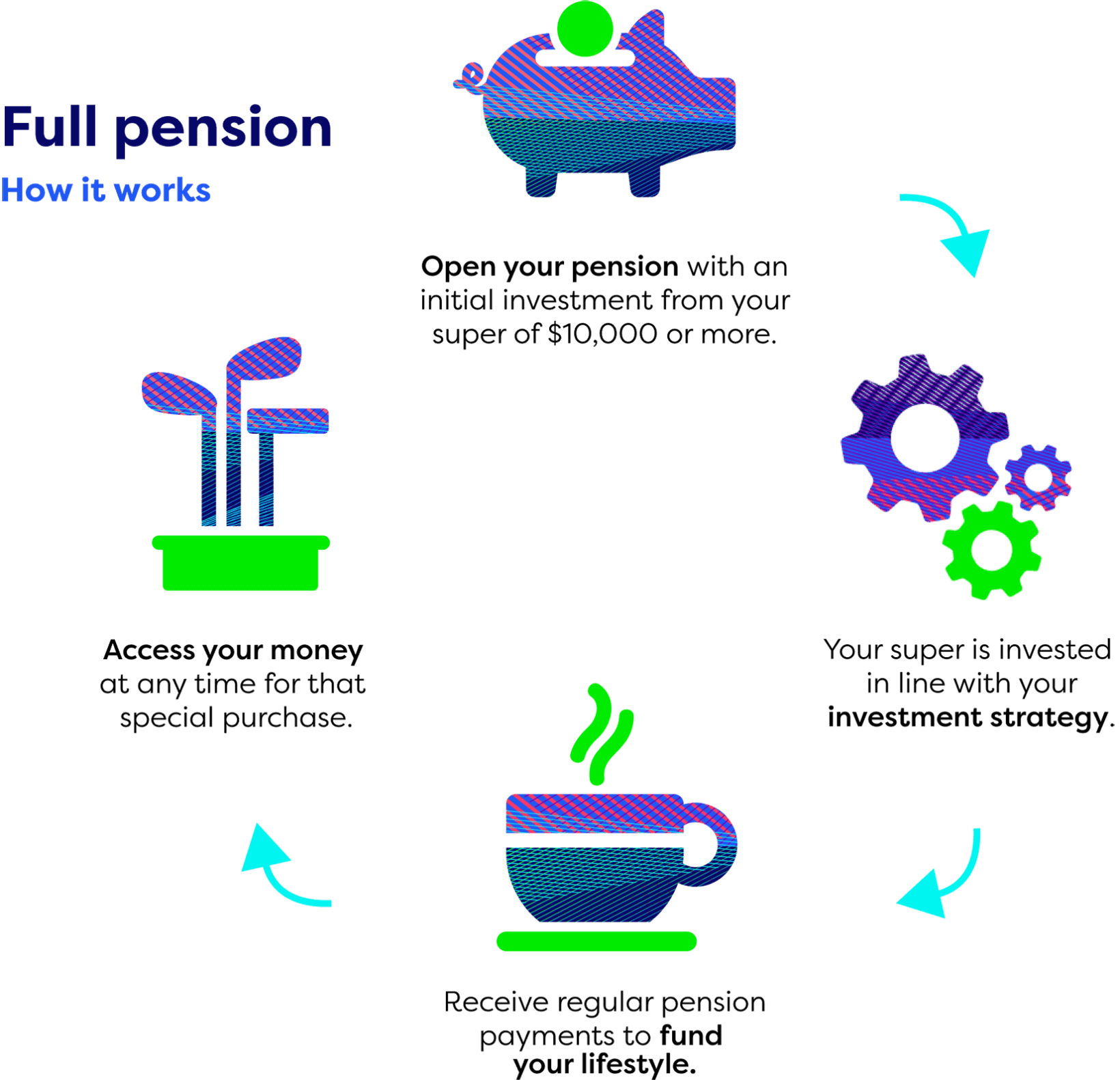

Opening a CareSuper Pension account with your super allows you to keep your money invested while you draw a regular income from it, so you have the confidence to enjoy your retirement.

What are the benefits?

Enjoy:

- Flexible income payments – choose how much and how often you receive payments (within government-set limits), and access lump sum payments if you need them

- Tax-free income payments – there’s no tax on your income payments once you reach age 60

- Tax-free investment earnings – your super will continue to earn you tax-free investment earnings, helping to boost your account balance and provide a retirement income for you for as long as possible

- Investment expertise – your super will be managed by investment professionals with expertise across a broad range of asset classes

- Strong investment returns – 8.7% average investment return in the Balanced option over 10 years*, and

- Online account management - manage your income easily through your online account.

Who’s eligible?

Anyone who's:

- Over preservation age and permanently retired

- Over 60 and stopped working for an employer, or

- 65 or over (even if working).

If you’re between your preservation age and 65 but you haven’t met the other criteria for a full CareSuper Pension, you might be able to start accessing some of your super with a transition to retirement strategy. Find out more about transitioning to retirement.

Let's plan together

If you're planning for a life after work, seeking financial advice through your super is a great option. We offer 3 different types of advice, based on your individual circumstances. Book a call-back.

We're here to help

If you have a super, retirement or pension-related question, call 1300 360 149, 8am-8pm (AET) weekdays, or get in touch online.

* SuperRatings Fund Crediting Rate survey SR50 Balanced (60-76) Index – June 2022.