Guaranteed Income product

Eliminate the risks of market falls, inflation and outliving your super

Life’s essentials will always be covered. That’s the main benefit of our Guaranteed Income account. It’s a regular income stream that will give you peace of mind in the face of market falls, inflationary pressures, and the risk of outliving your super.

What is a Guaranteed Income product?

A retirement account that provides you with a fixed and regular income, providing you with a safety net for basic living expenses such as food, electricity, and healthcare.

We offer two Guaranteed Income account options:

- Guaranteed Lifetime Income: you receive regular payments for your life, or you and your partner’s lifetimes.

- Guaranteed Fixed Term Income: you receive regular payments for an investment term of between 1 and 40 years.

The product (or combination of products) that’s right for you will depend on your specific situation and personal goals.

What are the benefits?

Enjoy:

- A regular income – the certainty of knowing how much your income payments will be over an agreed period, regardless of investment market conditions.

- Protection from market risk and inflation – there’s no market risk to your investment, helping you maintain the purchasing power of your regular payments.

- Income to last a lifetime – there’s no risk of outliving your savings, your income lasts you your lifetime and if you’ve chosen the reversionary option, the lifetime of your reversionary beneficiary.

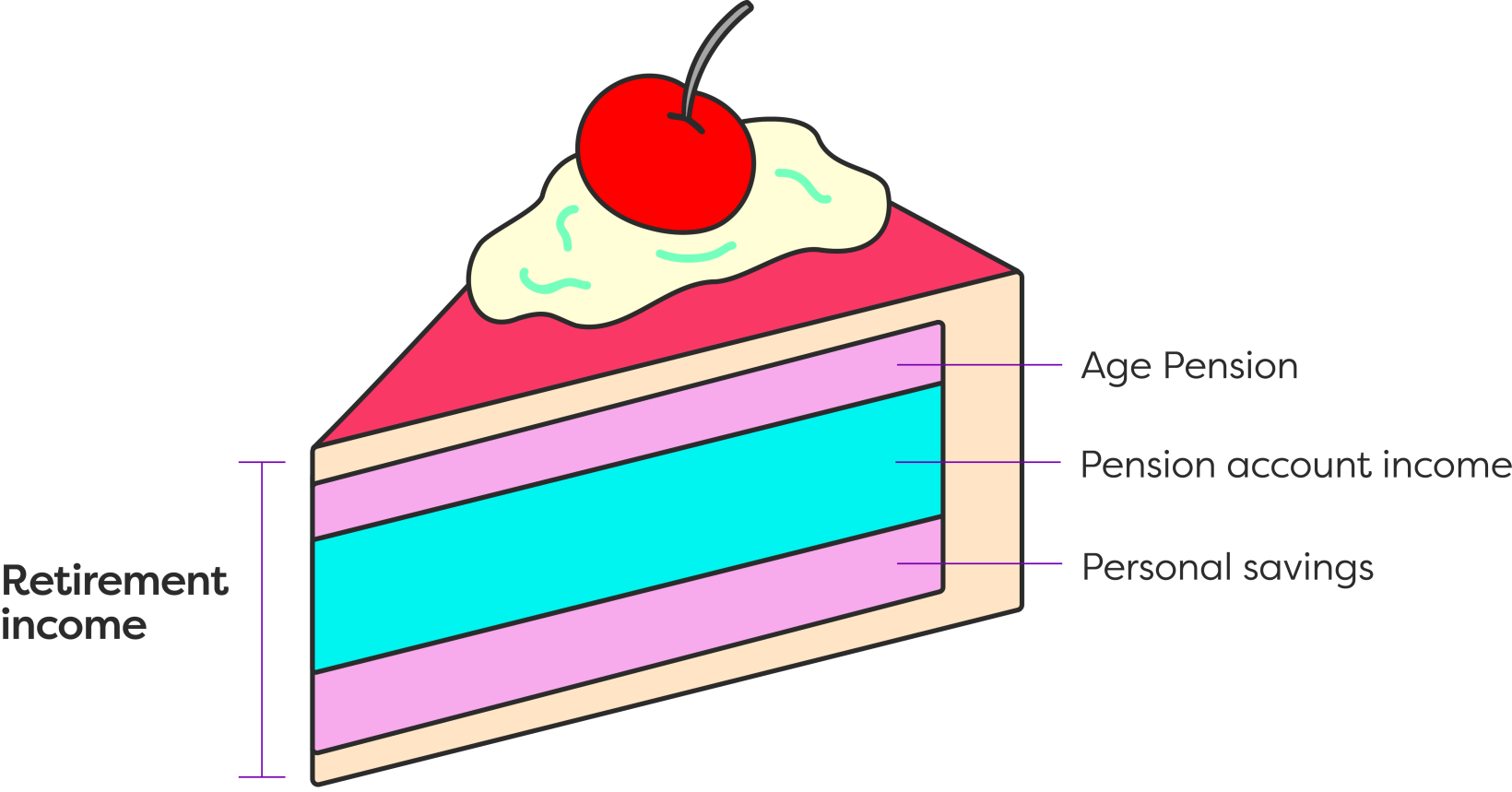

Layering your income

You can open a Guaranteed Income product by itself or combine it with a CareSuper Pension account. This is called ‘income layering’. It means that while your essentials are covered by your Guaranteed Income account, spending that varies – such as holidays or spoiling the grandkids – can be funded by more flexible income, such as your personal savings or your pension account.

Who can open a Guaranteed Income product?

You can open a Guaranteed Income account once a financial planner has agreed it’s appropriate for you.

To explore the product, read the PDS and book in to speak to a financial planner by calling us on 1300 360 149.

Let's plan together

If you're planning for a life after work, seeking financial advice through your super is a great option. We offer 3 different types of advice, based on your individual circumstances. Book a call-back.

We're here to help

If you have a super, retirement or pension-related question, call 1300 360 149, 8am-8pm (AET) weekdays, or get in touch online.